Where To Apply Tax Penalties In Quickbooks Accounts

Where To Apply Tax Penalties In Quickbooks Accounts - Then scroll down to the late return penalty & interest section and enter a 1 for late filing of return (1=automatic) and/or late. Submit your electronic services authorization forms to intuit. We’ll pay up to $25,000 in tax penalties per year. Identify the tax penalty : To apply tax penalties in quickbooks, follow these steps: In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Determine the type of tax penalty you. To apply tax penalties in quickbooks, follow these steps:

In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Identify the tax penalty : We’ll pay up to $25,000 in tax penalties per year. To apply tax penalties in quickbooks, follow these steps: Submit your electronic services authorization forms to intuit. To apply tax penalties in quickbooks, follow these steps: Then scroll down to the late return penalty & interest section and enter a 1 for late filing of return (1=automatic) and/or late. Determine the type of tax penalty you.

Submit your electronic services authorization forms to intuit. To apply tax penalties in quickbooks, follow these steps: Then scroll down to the late return penalty & interest section and enter a 1 for late filing of return (1=automatic) and/or late. Determine the type of tax penalty you. To apply tax penalties in quickbooks, follow these steps: We’ll pay up to $25,000 in tax penalties per year. Identify the tax penalty : In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in.

The IRS charges penalties for various reasons. Here are some penalties

Identify the tax penalty : To apply tax penalties in quickbooks, follow these steps: In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Then scroll down to the late return penalty & interest section and enter a 1 for late filing of return (1=automatic) and/or.

Federal Tax Authority sets 31 December 2022 as the deadline to apply

To apply tax penalties in quickbooks, follow these steps: We’ll pay up to $25,000 in tax penalties per year. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Identify the tax penalty : To apply tax penalties in quickbooks, follow these steps:

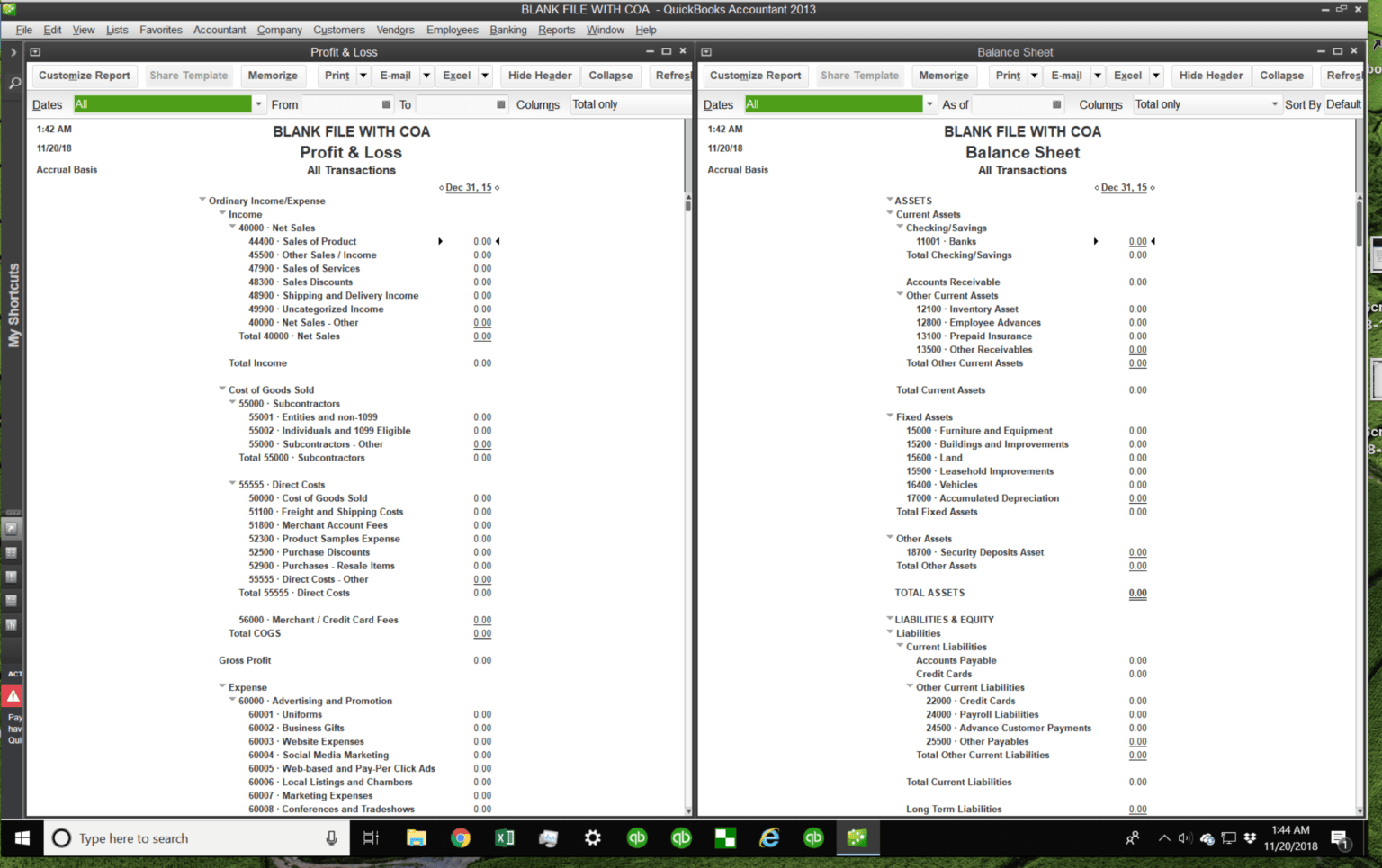

Real Estate Agent Chart Of Accounts

To apply tax penalties in quickbooks, follow these steps: Identify the tax penalty : In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Submit your electronic services authorization forms to intuit. We’ll pay up to $25,000 in tax penalties per year.

SOLVED The QuickBooks mobile app can do which of the following

Submit your electronic services authorization forms to intuit. To apply tax penalties in quickbooks, follow these steps: Identify the tax penalty : In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Then scroll down to the late return penalty & interest section and enter a.

Tax Penalties & Late Fees After Missing Audit Report Filing

To apply tax penalties in quickbooks, follow these steps: Submit your electronic services authorization forms to intuit. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Determine the type of tax penalty you. Then scroll down to the late return penalty & interest section and.

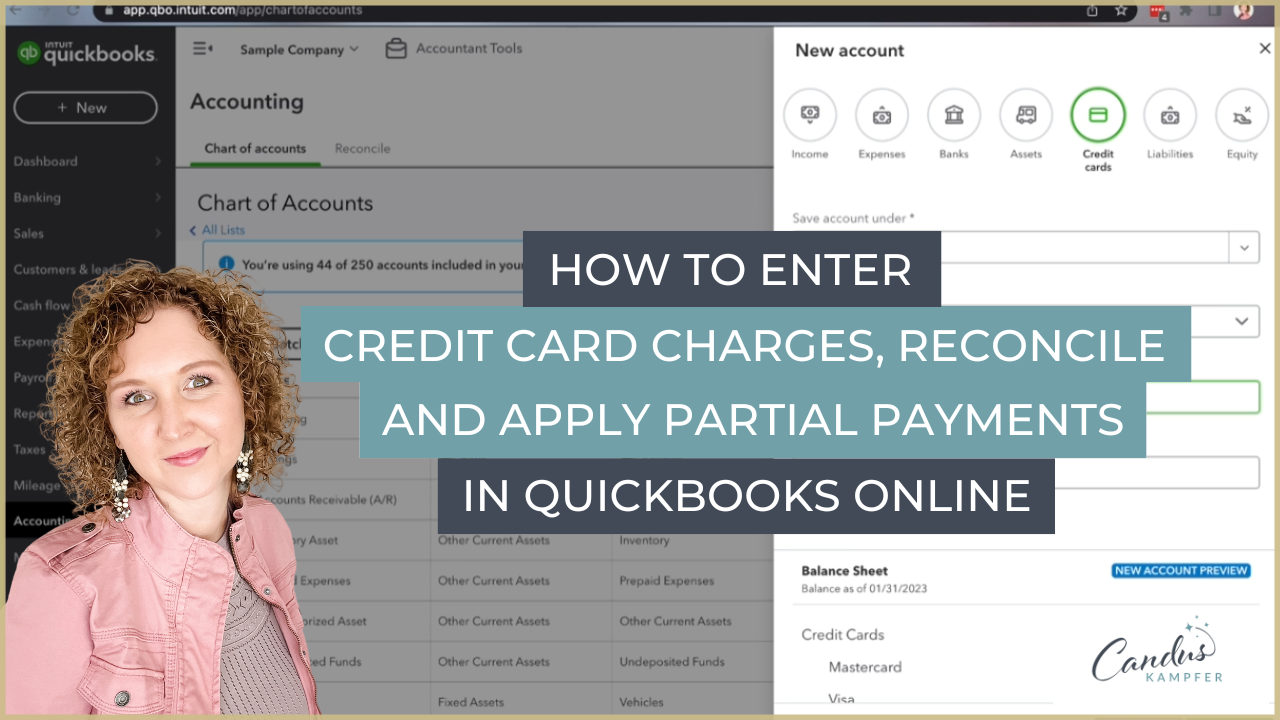

How to enter Credit Card Charges, Reconcile and apply Partial Payments

Identify the tax penalty : We’ll pay up to $25,000 in tax penalties per year. To apply tax penalties in quickbooks, follow these steps: Then scroll down to the late return penalty & interest section and enter a 1 for late filing of return (1=automatic) and/or late. To apply tax penalties in quickbooks, follow these steps:

Tax Base and Rates ppt download

Then scroll down to the late return penalty & interest section and enter a 1 for late filing of return (1=automatic) and/or late. Submit your electronic services authorization forms to intuit. Determine the type of tax penalty you. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the.

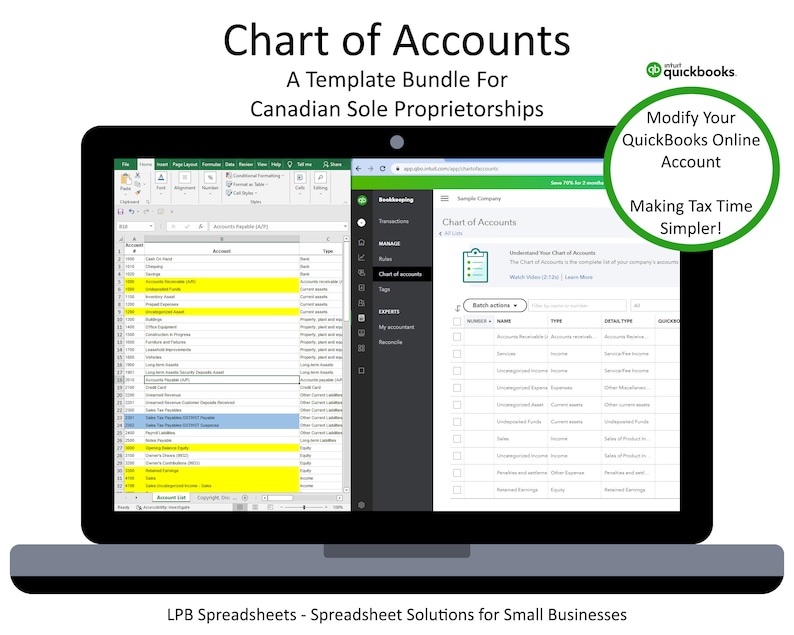

Chart of Accounts Template Bundle for Sole Proprietorships in Canada

In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Identify the tax penalty : To apply tax penalties in quickbooks, follow these steps: Determine the type of tax penalty you. To apply tax penalties in quickbooks, follow these steps:

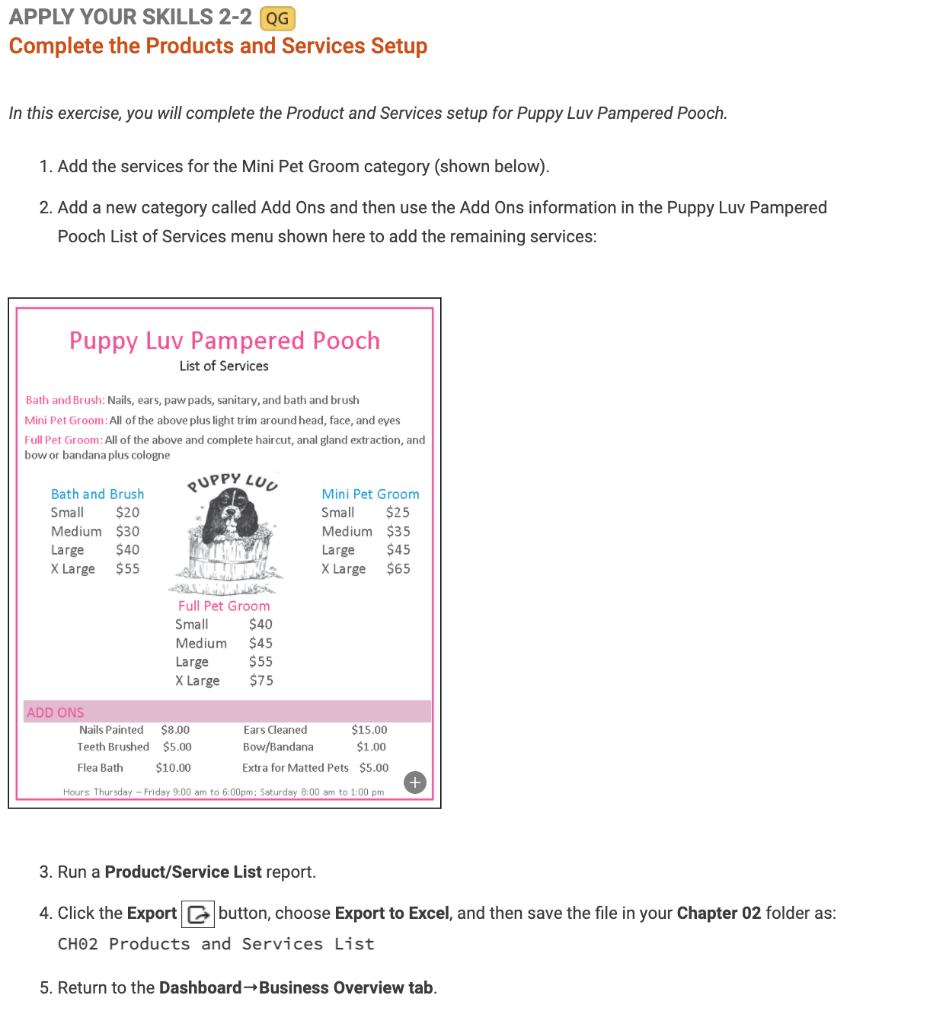

Complete Apply Your Skills 21 in your QuickBooks

Identify the tax penalty : Submit your electronic services authorization forms to intuit. To apply tax penalties in quickbooks, follow these steps: In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Then scroll down to the late return penalty & interest section and enter a.

The IRS Is Waiving 1 Billion in Penalties for Americans That Owe Back

To apply tax penalties in quickbooks, follow these steps: To apply tax penalties in quickbooks, follow these steps: Then scroll down to the late return penalty & interest section and enter a 1 for late filing of return (1=automatic) and/or late. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to.

In Quickbooks Online, The Correct Way To Record Tax Penalties And Interest Is By Making A Journal Entry To Account For The Change In.

Then scroll down to the late return penalty & interest section and enter a 1 for late filing of return (1=automatic) and/or late. Determine the type of tax penalty you. We’ll pay up to $25,000 in tax penalties per year. To apply tax penalties in quickbooks, follow these steps:

To Apply Tax Penalties In Quickbooks, Follow These Steps:

Identify the tax penalty : Submit your electronic services authorization forms to intuit.