What Is A Tax Refund Recorded As In Quickbooks

What Is A Tax Refund Recorded As In Quickbooks - I have just the steps that'll help you record the liability refund. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will. The steps below will guide you through the process: In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In this article, we will guide you on how to record a tax refund in quickbooks. Why record a tax refund in quickbooks?

In this article, we will. In this article, we will guide you on how to record a tax refund in quickbooks. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. The steps below will guide you through the process: To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. I have just the steps that'll help you record the liability refund. Why record a tax refund in quickbooks?

To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. The steps below will guide you through the process: In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will. I have just the steps that'll help you record the liability refund. Why record a tax refund in quickbooks? In this article, we will guide you on how to record a tax refund in quickbooks.

How To File A United States Federal Tax Return

In this article, we will. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. Why record a tax refund in quickbooks? The steps below will guide you through the process: To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax.

tax refund complaint Guide)

In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Why record a tax refund in.

How Long Does it Take to Get Your Tax Refund? A Comprehensive Guide

I have just the steps that'll help you record the liability refund. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will guide you on how to record a tax refund in quickbooks. In this article, we will. To record tax refunds in quickbooks, businesses need to follow specific steps.

How to raise your chances of getting a bigger tax refund next year

Why record a tax refund in quickbooks? I have just the steps that'll help you record the liability refund. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will guide you on how to record a tax refund in quickbooks. The steps below will guide you through the process:

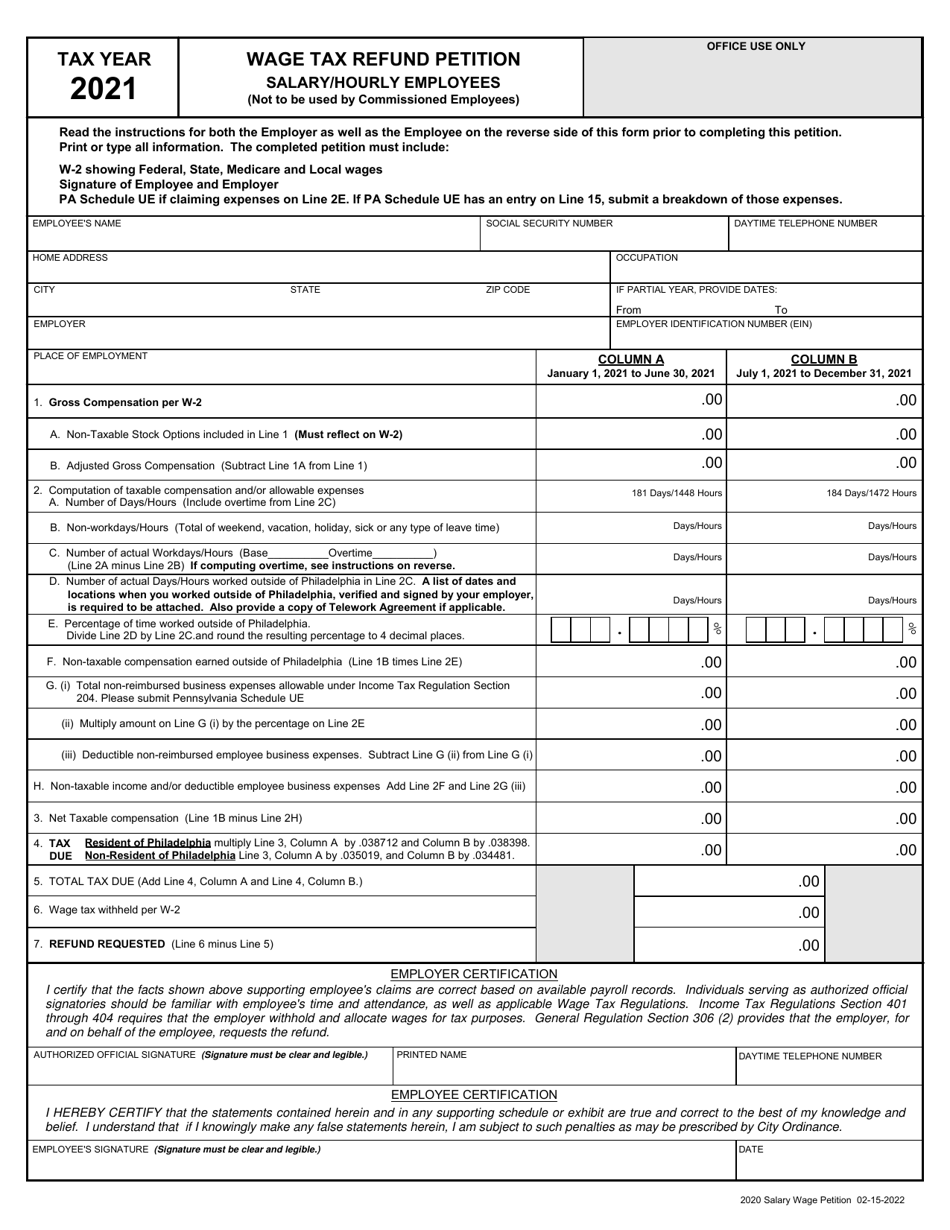

2021 City of Philadelphia, Pennsylvania Wage Tax Refund Petition

To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. I have just the steps that'll help you record the liability refund. In this article, we will. The steps below will guide you through the process: Why record a tax refund in quickbooks?

Tax Refund How Claim TDS Refund Online

In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. In this article, we will guide you on how to record a tax refund in quickbooks. In this article, we will. The steps below will guide you through the process: In quickbooks online, tax refunds should be categorized under specific income accounts.

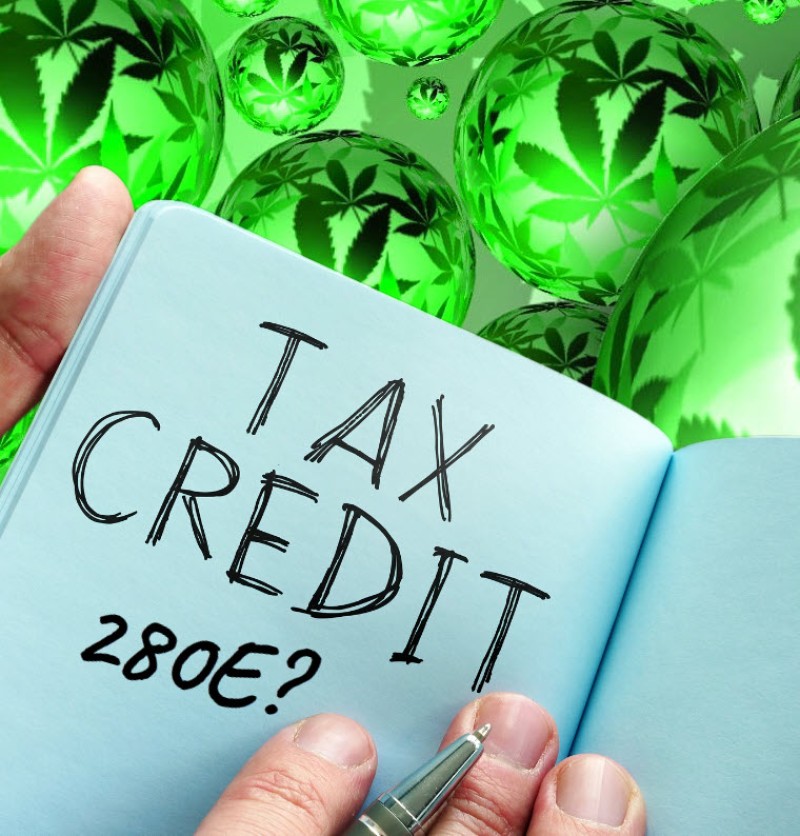

Cannabis Companies Could Be Sitting on Billions of Dollars in Tax

Why record a tax refund in quickbooks? To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will guide you on how to record a tax refund in quickbooks. In.

Tax Refund Payment How long does it take for tax refund to show in

I have just the steps that'll help you record the liability refund. In this article, we will. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In quickbooks, the most appropriate category for.

IRS Cyberattack Highlights Risk of Tax Refund Fraud Recorded Future

In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will guide you on how to record a tax refund in quickbooks. I have just the steps that'll help you record the liability refund. Why record a tax refund in quickbooks? In this article, we will.

My 8,220 tax refund disappeared I’ve been warned 'free' is rarely

To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. I have just the steps that'll help you record the liability refund. In this article, we will guide you on how to record a tax refund in quickbooks. In quickbooks online, tax refunds should be categorized under specific income.

In This Article, We Will Guide You On How To Record A Tax Refund In Quickbooks.

In this article, we will. I have just the steps that'll help you record the liability refund. In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds.

Why Record A Tax Refund In Quickbooks?

To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. The steps below will guide you through the process: