Shopify Tax Forms

Shopify Tax Forms - What forms do you need to file your shopify 1099 taxes? There are three main forms you fill out when you file your taxes: The good news is that we put together this article to break down everything you need to. Schedule se, where you calculate. What about specific shopify tax forms or shopify tax documents? These are all great questions to ask yourself leading up to filing your income tax return. Schedule c, where you report your gross business income and expenses; Definitely a great place to gather some input regarding anything about the platform! You receive more than 20,000 usd in gross. For calendar years prior to (and including) 2023:

There are three main forms you fill out when you file your taxes: You receive more than 20,000 usd in gross. For calendar years prior to (and including) 2023: Schedule c, where you report your gross business income and expenses; What about specific shopify tax forms or shopify tax documents? What forms do you need to file your shopify 1099 taxes? Definitely a great place to gather some input regarding anything about the platform! Schedule se, where you calculate. The good news is that we put together this article to break down everything you need to. These are all great questions to ask yourself leading up to filing your income tax return.

Schedule se, where you calculate. These are all great questions to ask yourself leading up to filing your income tax return. There are three main forms you fill out when you file your taxes: What about specific shopify tax forms or shopify tax documents? What forms do you need to file your shopify 1099 taxes? Schedule c, where you report your gross business income and expenses; The good news is that we put together this article to break down everything you need to. Definitely a great place to gather some input regarding anything about the platform! For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross.

How to increase your sales on Shopify Zoho Blog

These are all great questions to ask yourself leading up to filing your income tax return. There are three main forms you fill out when you file your taxes: Schedule c, where you report your gross business income and expenses; The good news is that we put together this article to break down everything you need to. What about specific.

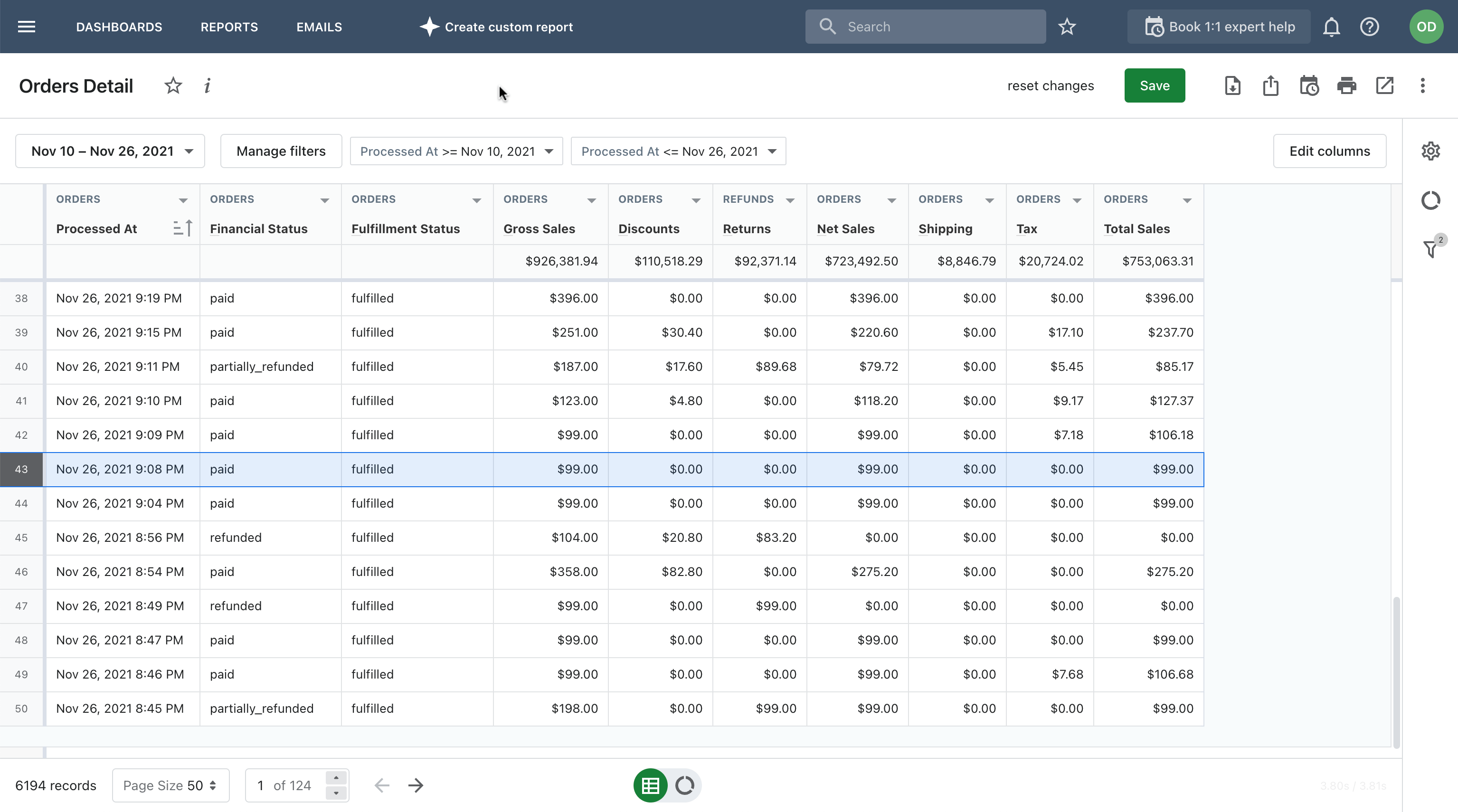

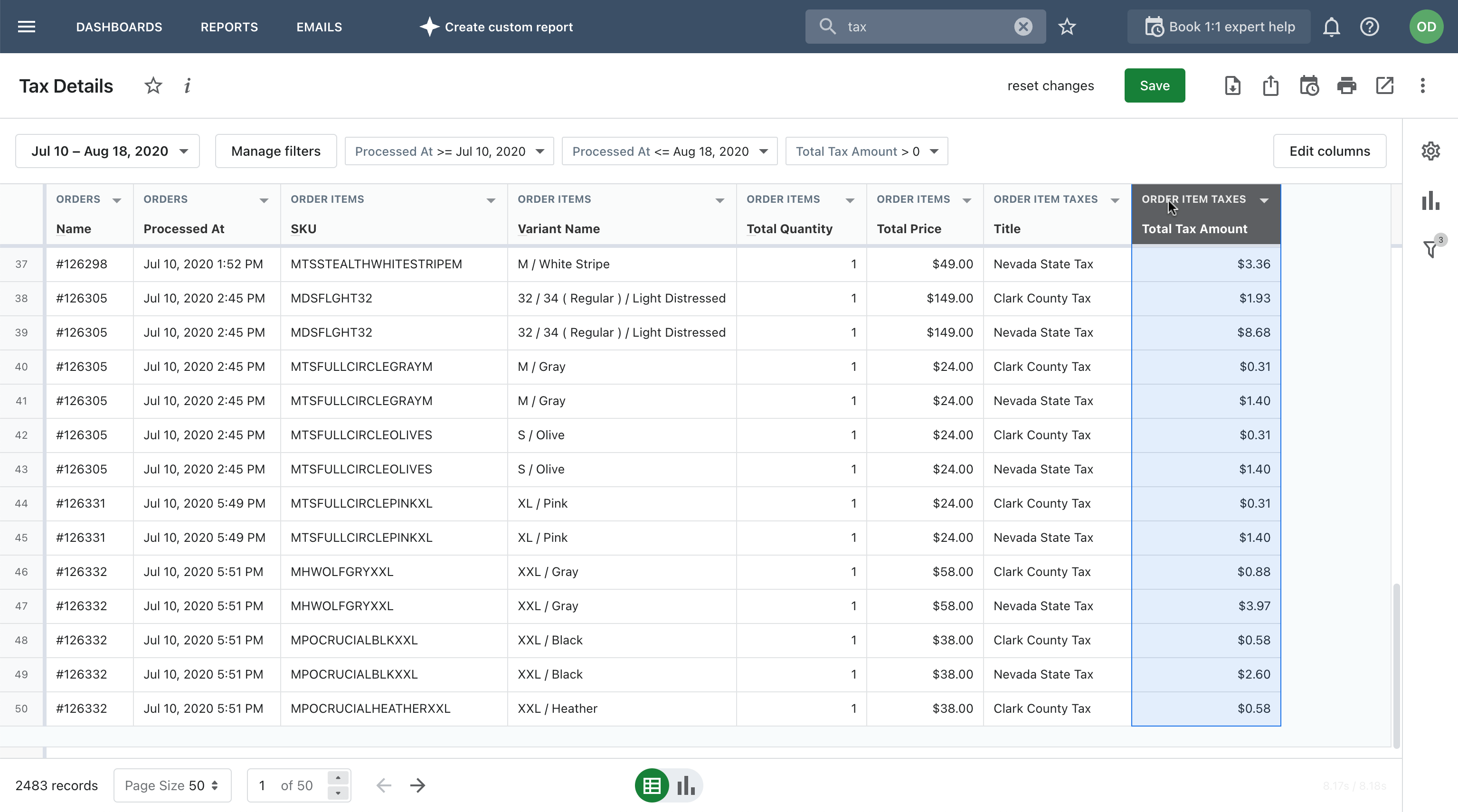

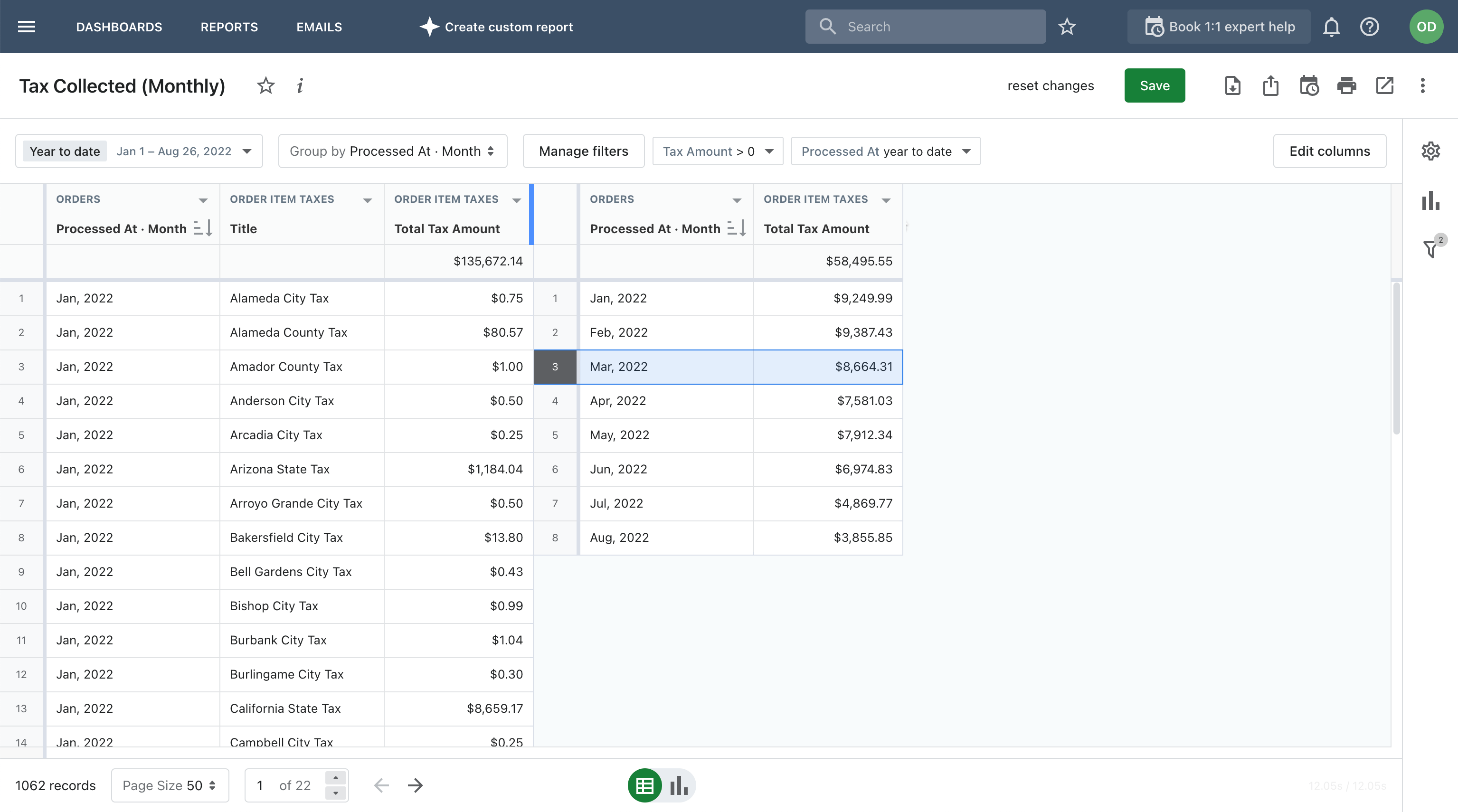

Shopify Tax Reports and How to Make Them More Flexible Selfservice

The good news is that we put together this article to break down everything you need to. You receive more than 20,000 usd in gross. There are three main forms you fill out when you file your taxes: What forms do you need to file your shopify 1099 taxes? Schedule se, where you calculate.

What does it mean miscellaneous payment? Leia aqui What is

For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross. The good news is that we put together this article to break down everything you need to. There are three main forms you fill out when you file your taxes: Definitely a great place to gather some input regarding anything about the platform!

The Ultimate Beginners Shopify Sales Tax Guide A2X

What about specific shopify tax forms or shopify tax documents? What forms do you need to file your shopify 1099 taxes? The good news is that we put together this article to break down everything you need to. Definitely a great place to gather some input regarding anything about the platform! There are three main forms you fill out when.

Canada Shopify tax invoice template in Word and PDF format, fully editable

The good news is that we put together this article to break down everything you need to. What about specific shopify tax forms or shopify tax documents? You receive more than 20,000 usd in gross. There are three main forms you fill out when you file your taxes: Schedule c, where you report your gross business income and expenses;

Shopify Tax Reports and How to Make Them More Flexible Selfservice

For calendar years prior to (and including) 2023: What forms do you need to file your shopify 1099 taxes? Schedule c, where you report your gross business income and expenses; You receive more than 20,000 usd in gross. Schedule se, where you calculate.

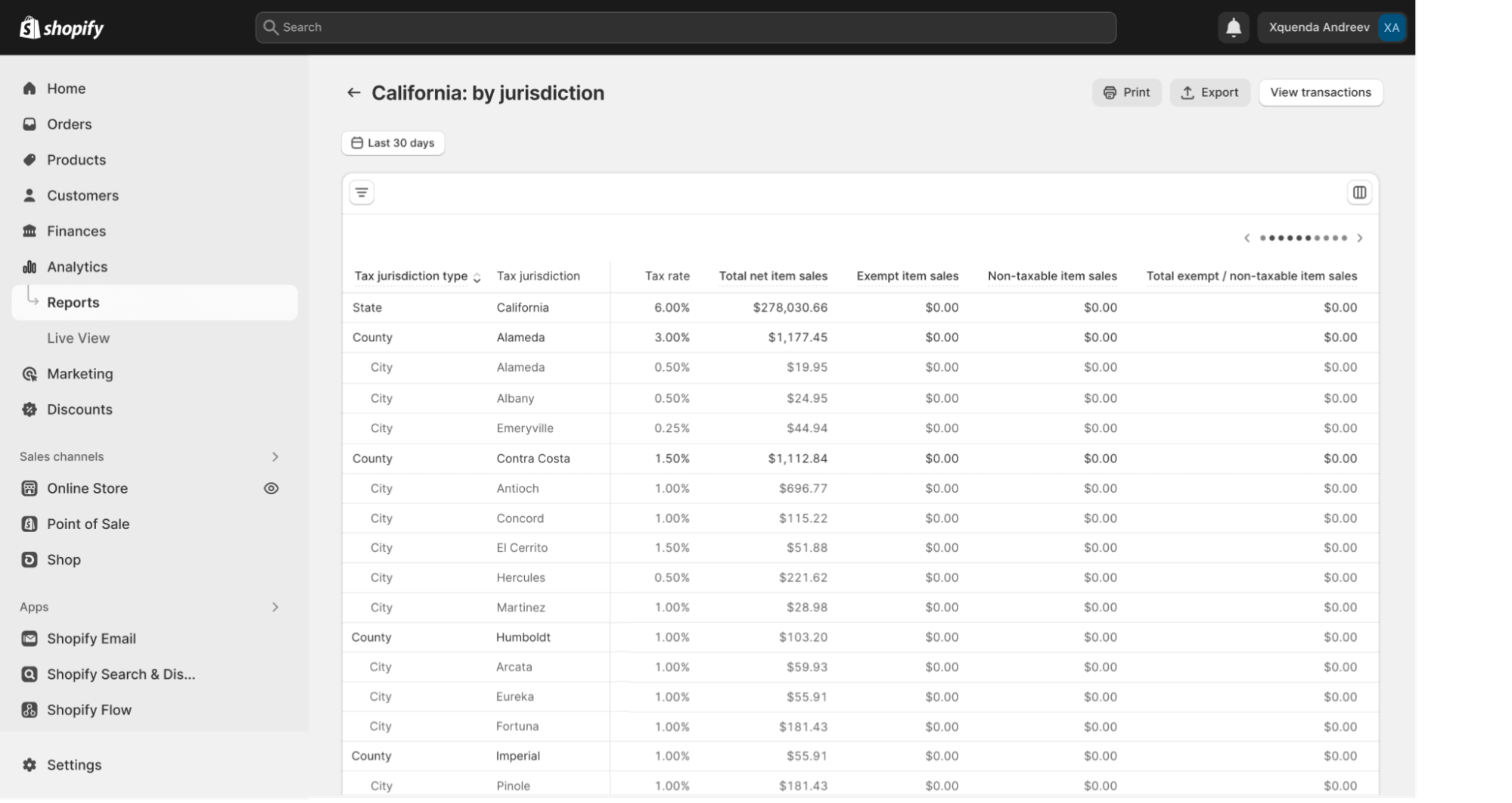

Introducing Better Sales Tax Reporting in Shopify Tax (2023) Shopify

You receive more than 20,000 usd in gross. For calendar years prior to (and including) 2023: The good news is that we put together this article to break down everything you need to. What about specific shopify tax forms or shopify tax documents? Definitely a great place to gather some input regarding anything about the platform!

Shopify Tax Reports and How to Make Them More Flexible Selfservice

The good news is that we put together this article to break down everything you need to. For calendar years prior to (and including) 2023: Schedule c, where you report your gross business income and expenses; What about specific shopify tax forms or shopify tax documents? Schedule se, where you calculate.

Introducing Shopify Forms Grow Your Marketing List, for Free (2023)

These are all great questions to ask yourself leading up to filing your income tax return. The good news is that we put together this article to break down everything you need to. Definitely a great place to gather some input regarding anything about the platform! Schedule se, where you calculate. What about specific shopify tax forms or shopify tax.

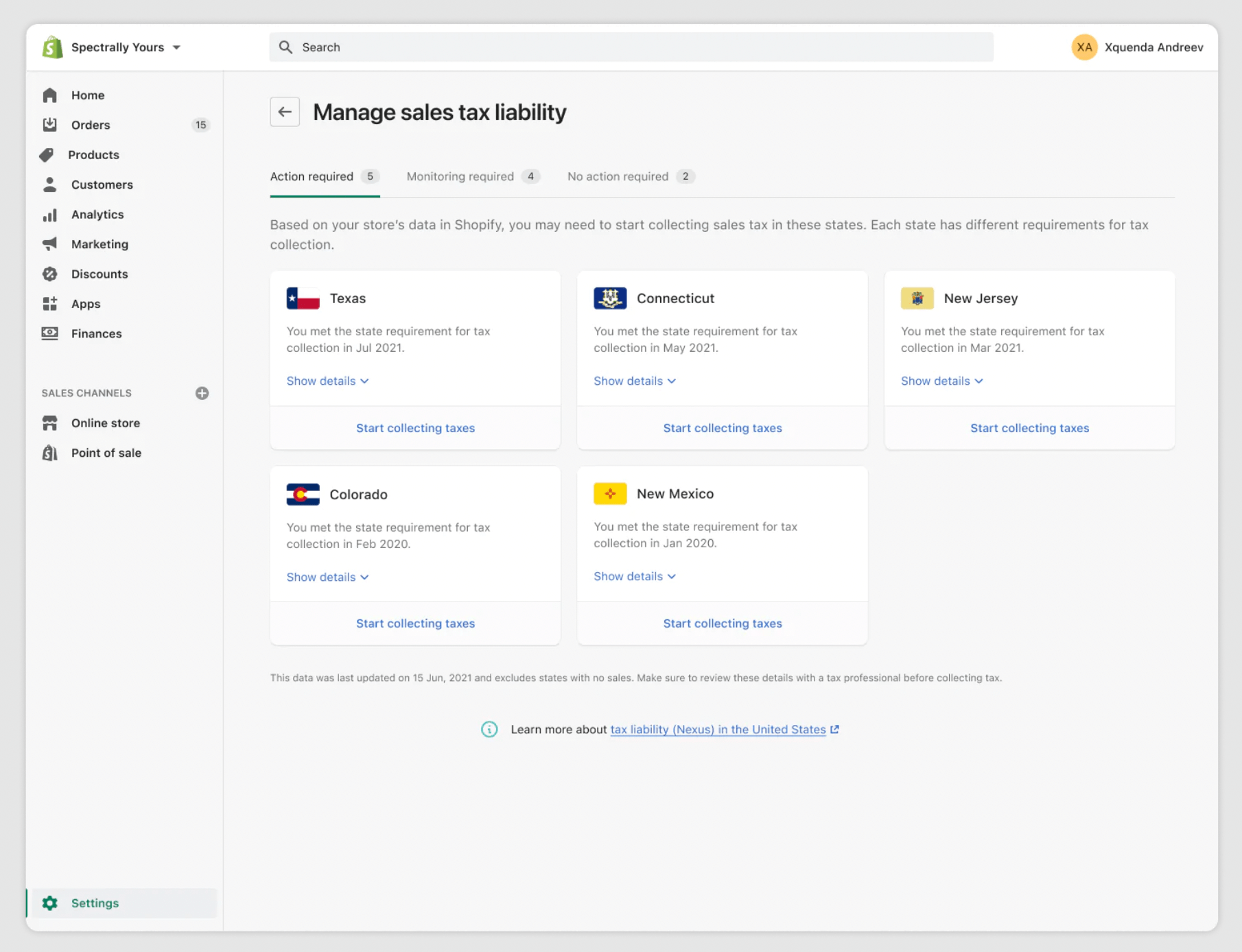

A Helpful Guide to Setting Up Taxes on Shopify

What about specific shopify tax forms or shopify tax documents? Definitely a great place to gather some input regarding anything about the platform! These are all great questions to ask yourself leading up to filing your income tax return. What forms do you need to file your shopify 1099 taxes? You receive more than 20,000 usd in gross.

You Receive More Than 20,000 Usd In Gross.

What forms do you need to file your shopify 1099 taxes? These are all great questions to ask yourself leading up to filing your income tax return. For calendar years prior to (and including) 2023: What about specific shopify tax forms or shopify tax documents?

There Are Three Main Forms You Fill Out When You File Your Taxes:

Schedule c, where you report your gross business income and expenses; Schedule se, where you calculate. Definitely a great place to gather some input regarding anything about the platform! The good news is that we put together this article to break down everything you need to.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)