Shopify Sales Tax California Limit

Shopify Sales Tax California Limit - I understand you're looking to see if your business qualifies for nexus tax in california. Different counties and cities apply additional rates on top of this. The base rate is 7.25%. Yes, shopify does collect sales tax in california. The state rate of sales tax for california is 7.25%. In general, sales tax is collected on the total purchase price of taxable goods and. Some states have sales tax. Businesses must collect sales tax if they exceed $500,000 in sales annually. They also range considerably from 7.25% for california state sales taxes to just 2.9% in colorado. It's important to note that we aren't able to.

The base rate is 7.25%. They also range considerably from 7.25% for california state sales taxes to just 2.9% in colorado. I understand you're looking to see if your business qualifies for nexus tax in california. It's important to note that we aren't able to. Some states have sales tax. In general, sales tax is collected on the total purchase price of taxable goods and. Businesses must collect sales tax if they exceed $500,000 in sales annually. Different counties and cities apply additional rates on top of this. The state rate of sales tax for california is 7.25%. Yes, shopify does collect sales tax in california.

The state rate of sales tax for california is 7.25%. I understand you're looking to see if your business qualifies for nexus tax in california. It's important to note that we aren't able to. Yes, shopify does collect sales tax in california. Some states have sales tax. Different counties and cities apply additional rates on top of this. They also range considerably from 7.25% for california state sales taxes to just 2.9% in colorado. The base rate is 7.25%. In general, sales tax is collected on the total purchase price of taxable goods and. Businesses must collect sales tax if they exceed $500,000 in sales annually.

Shopify Sales Tax The Complete Guide

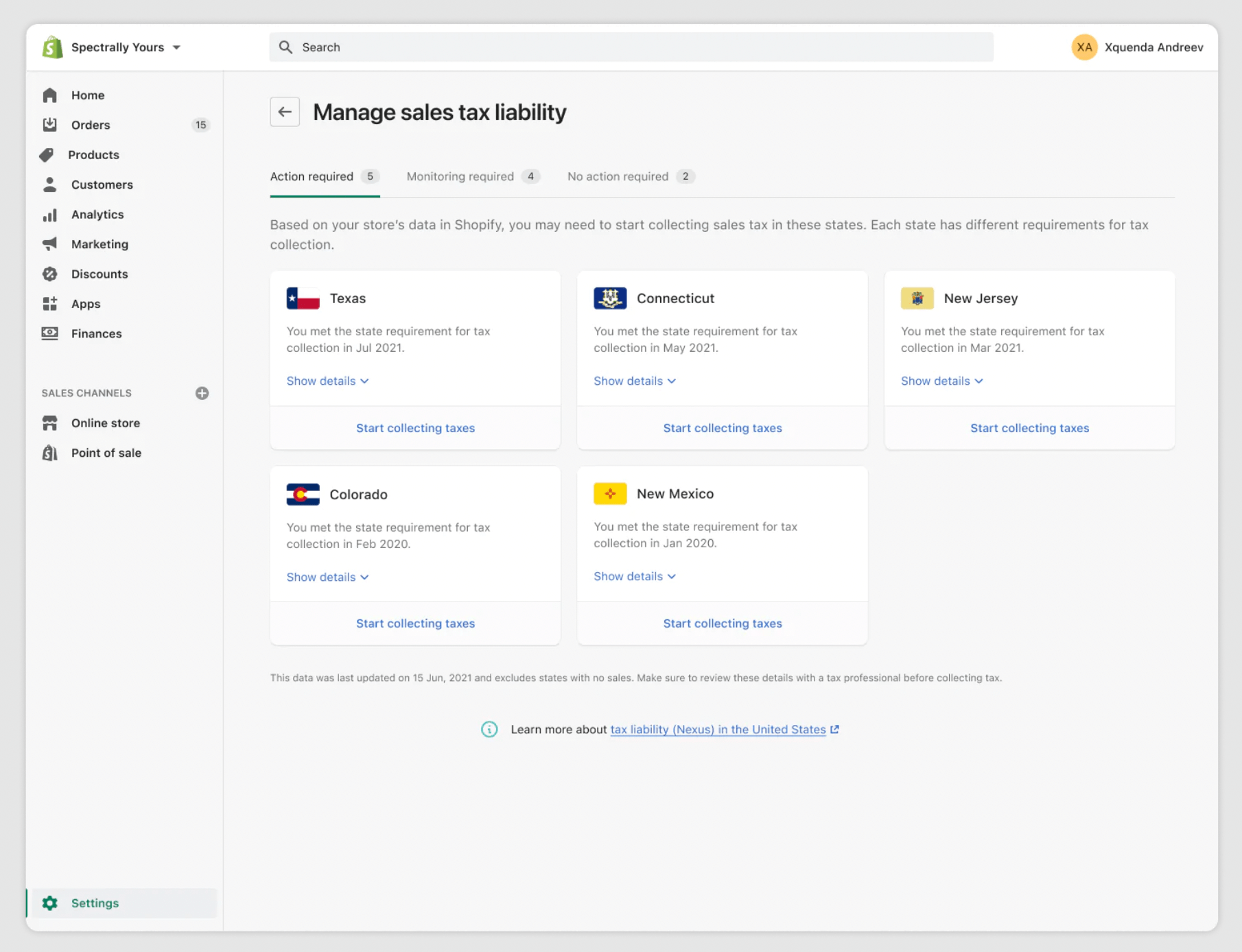

I understand you're looking to see if your business qualifies for nexus tax in california. Businesses must collect sales tax if they exceed $500,000 in sales annually. The base rate is 7.25%. They also range considerably from 7.25% for california state sales taxes to just 2.9% in colorado. Some states have sales tax.

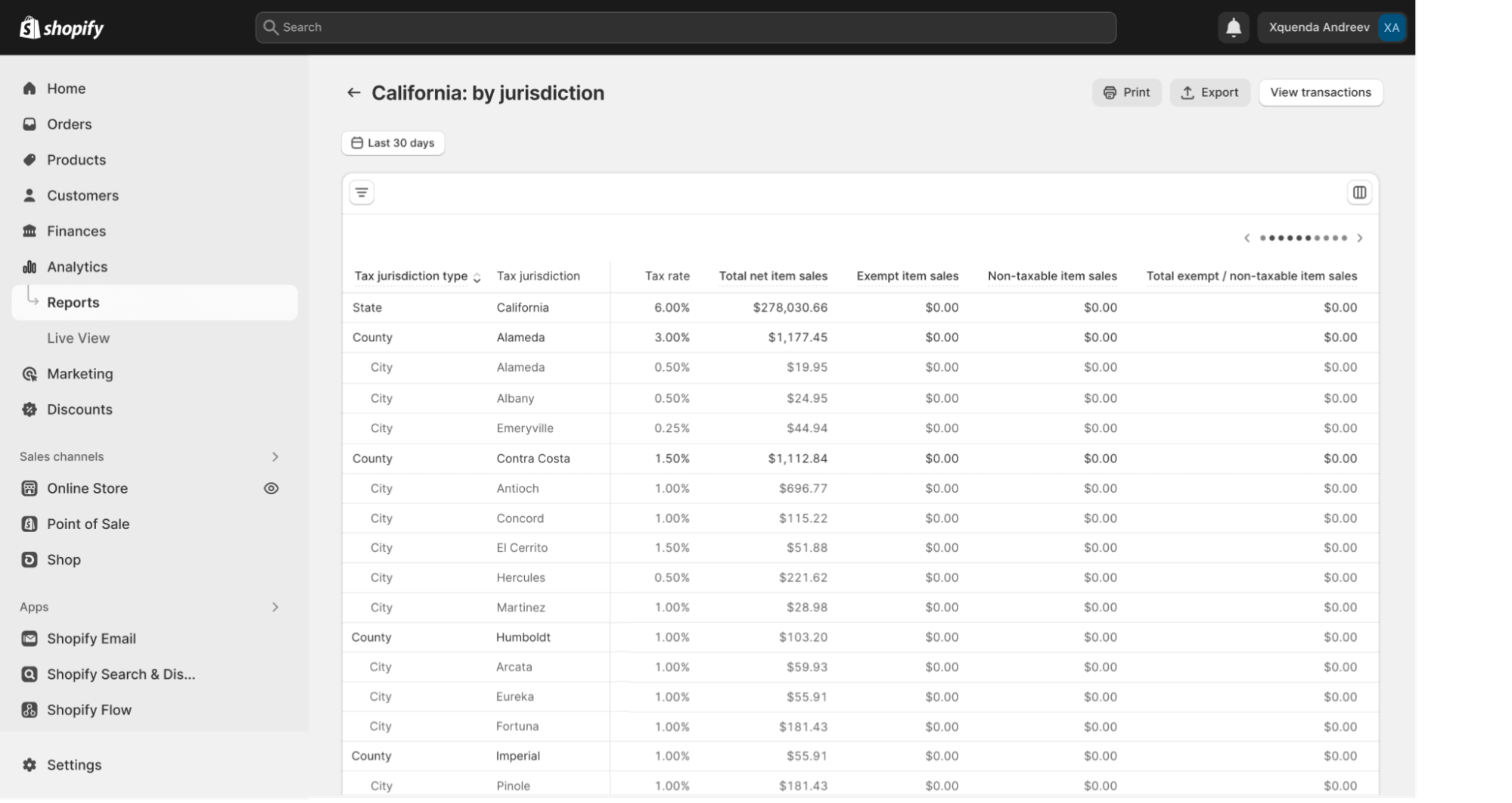

Introducing Better Sales Tax Reporting in Shopify Tax (2023) Shopify

Different counties and cities apply additional rates on top of this. In general, sales tax is collected on the total purchase price of taxable goods and. The state rate of sales tax for california is 7.25%. Yes, shopify does collect sales tax in california. The base rate is 7.25%.

Shopify sales tax All you need to know Updimes

I understand you're looking to see if your business qualifies for nexus tax in california. Businesses must collect sales tax if they exceed $500,000 in sales annually. Different counties and cities apply additional rates on top of this. The state rate of sales tax for california is 7.25%. In general, sales tax is collected on the total purchase price of.

Shopify sales tax All you need to know Updimes

I understand you're looking to see if your business qualifies for nexus tax in california. They also range considerably from 7.25% for california state sales taxes to just 2.9% in colorado. Yes, shopify does collect sales tax in california. Different counties and cities apply additional rates on top of this. The base rate is 7.25%.

Top 5 Shopify Sales Tax Software Of 2024 FreeCashFlow.io 2024

Yes, shopify does collect sales tax in california. The base rate is 7.25%. Businesses must collect sales tax if they exceed $500,000 in sales annually. It's important to note that we aren't able to. In general, sales tax is collected on the total purchase price of taxable goods and.

Shopify Sales Tax The Ultimate Guide In 2023

Different counties and cities apply additional rates on top of this. The base rate is 7.25%. It's important to note that we aren't able to. Some states have sales tax. Yes, shopify does collect sales tax in california.

Shopify Sales Tax Tips and Tricks FreeCashFlow.io 2024

I understand you're looking to see if your business qualifies for nexus tax in california. The base rate is 7.25%. Businesses must collect sales tax if they exceed $500,000 in sales annually. The state rate of sales tax for california is 7.25%. In general, sales tax is collected on the total purchase price of taxable goods and.

How to adjust Shopify sales tax rates FreeCashFlow.io 2024

Yes, shopify does collect sales tax in california. Different counties and cities apply additional rates on top of this. They also range considerably from 7.25% for california state sales taxes to just 2.9% in colorado. The state rate of sales tax for california is 7.25%. The base rate is 7.25%.

The Ultimate Beginners Shopify Sales Tax Guide A2X

The state rate of sales tax for california is 7.25%. I understand you're looking to see if your business qualifies for nexus tax in california. It's important to note that we aren't able to. The base rate is 7.25%. Different counties and cities apply additional rates on top of this.

Shopify Sales Tax Report StepByStep Guide Selfservice BI

Businesses must collect sales tax if they exceed $500,000 in sales annually. It's important to note that we aren't able to. In general, sales tax is collected on the total purchase price of taxable goods and. The base rate is 7.25%. Different counties and cities apply additional rates on top of this.

Yes, Shopify Does Collect Sales Tax In California.

The base rate is 7.25%. In general, sales tax is collected on the total purchase price of taxable goods and. It's important to note that we aren't able to. They also range considerably from 7.25% for california state sales taxes to just 2.9% in colorado.

Businesses Must Collect Sales Tax If They Exceed $500,000 In Sales Annually.

The state rate of sales tax for california is 7.25%. I understand you're looking to see if your business qualifies for nexus tax in california. Some states have sales tax. Different counties and cities apply additional rates on top of this.