Shopify Price To Earnings

Shopify Price To Earnings - The price to earnings ratio is calculated by taking the latest. Shopify has a market cap or net worth of $139.78 billion. Price to earnings ratio or p/e is price / earnings. The current price to earnings ratio for shop is 662.77% higher than the 10 year average. The next estimated earnings date is. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. It is the most commonly used metric for determining a company's value relative to. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps. View pe ratio for shop. The enterprise value is $136.03 billion.

The enterprise value is $136.03 billion. Price to earnings ratio or p/e is price / earnings. The price to earnings ratio is calculated by taking the latest. The next estimated earnings date is. The current price to earnings ratio for shop is 662.77% higher than the 10 year average. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. View pe ratio for shop. Shopify has a market cap or net worth of $139.78 billion. It is the most commonly used metric for determining a company's value relative to. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps.

The next estimated earnings date is. It is the most commonly used metric for determining a company's value relative to. Shopify has a market cap or net worth of $139.78 billion. The current price to earnings ratio for shop is 662.77% higher than the 10 year average. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps. Price to earnings ratio or p/e is price / earnings. The enterprise value is $136.03 billion. The price to earnings ratio is calculated by taking the latest. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. View pe ratio for shop.

Can you make a living off Shopify?

The enterprise value is $136.03 billion. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps. View pe ratio for shop. The price to earnings ratio is calculated by taking the latest. The next estimated earnings date is.

Typedream vs Shopify (2024) Which Should You Choose? Platforms

View pe ratio for shop. Shopify has a market cap or net worth of $139.78 billion. The next estimated earnings date is. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps. Price to earnings ratio or p/e is price / earnings.

Rankpot SEO Agency

The next estimated earnings date is. The price to earnings ratio is calculated by taking the latest. The enterprise value is $136.03 billion. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps.

8 MustHave Shopify Apps in India to Grow Your Business

The next estimated earnings date is. The price to earnings ratio is calculated by taking the latest. It is the most commonly used metric for determining a company's value relative to. Price to earnings ratio or p/e is price / earnings. The enterprise value is $136.03 billion.

Will Shopify’s share price keep rising after Q3 earnings?

Price to earnings ratio or p/e is price / earnings. The next estimated earnings date is. The enterprise value is $136.03 billion. The price to earnings ratio is calculated by taking the latest. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024.

Shopify Stock Is on a Roll How Far Can It Go? TheStreet

The enterprise value is $136.03 billion. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps. View pe ratio for shop. The current price to earnings ratio for shop is 662.77% higher than the 10 year average. The price to earnings ratio is calculated by taking the latest.

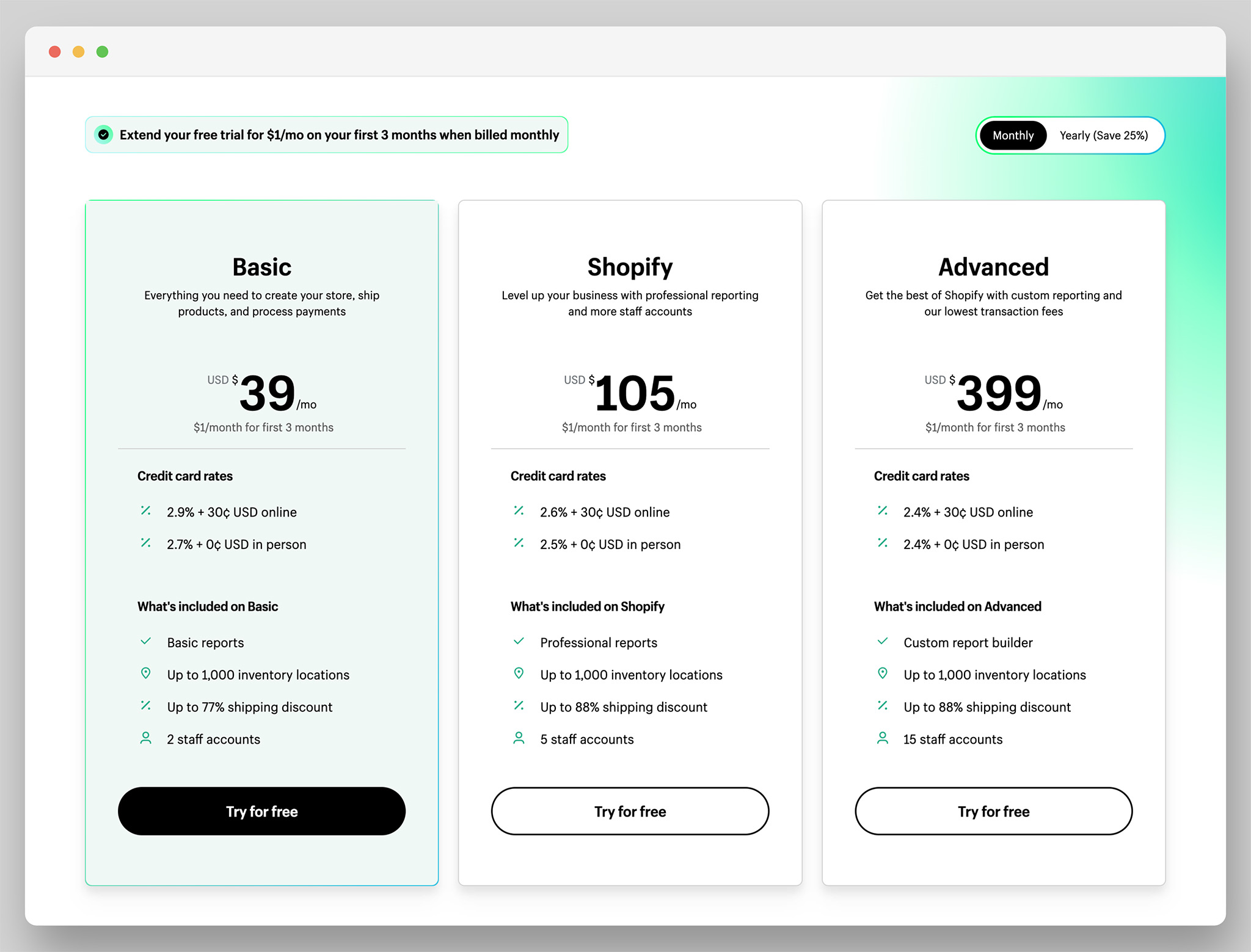

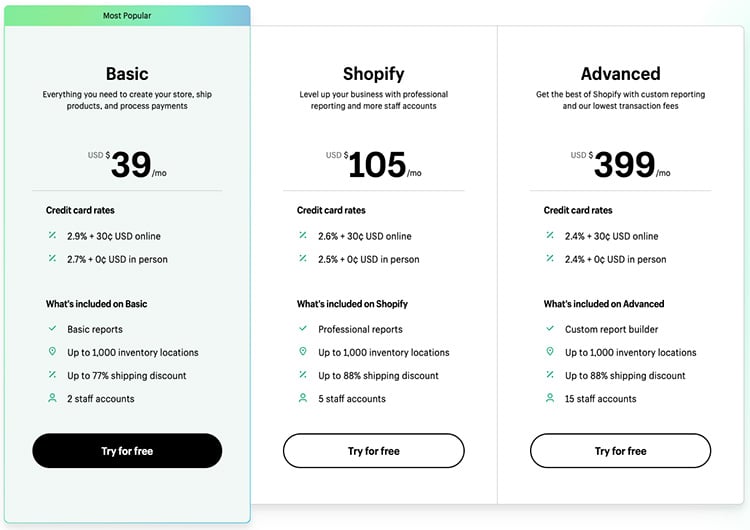

Shopify Pricing and Fees 2024 Which Plan is Right For You?

Price to earnings ratio or p/e is price / earnings. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. The enterprise value is $136.03 billion. The next estimated earnings date is. The current price to earnings ratio for shop is 662.77% higher than the 10 year average.

How to increase your sales on Shopify Zoho Blog

50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. The current price to earnings ratio for shop is 662.77% higher than the 10 year average. It is the most commonly used metric for determining a company's value relative to. Price to earnings ratio or p/e is price / earnings. The price to earnings ratio is.

8 Shopify Dropshipping Tips to Scale Your Business in 2023

50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. The next estimated earnings date is. Price to earnings ratio or p/e is price / earnings. Shopify has a market cap or net worth of $139.78 billion. View pe ratio for shop.

Shopify Stock Rockets to AllTime High After Earnings

The current price to earnings ratio for shop is 662.77% higher than the 10 year average. The next estimated earnings date is. The price to earnings ratio is calculated by taking the latest. It is the most commonly used metric for determining a company's value relative to. The price to earnings ratio (pe ratio) is calculated by taking the stock.

View Pe Ratio For Shop.

The enterprise value is $136.03 billion. Price to earnings ratio or p/e is price / earnings. The price to earnings ratio is calculated by taking the latest. It is the most commonly used metric for determining a company's value relative to.

50 Rows Current And Historical P/E Ratio For Shopify (Shop) From 2013 To 2024.

The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps. Shopify has a market cap or net worth of $139.78 billion. The current price to earnings ratio for shop is 662.77% higher than the 10 year average. The next estimated earnings date is.

:max_bytes(150000):strip_icc()/shop2-b93a53047e10465aaed47ff5a1f096cb.jpg)