Record Employee Cash Payment In Quickbooks Online

Record Employee Cash Payment In Quickbooks Online - You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need.

I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. You can pay your employee in advance by running an unscheduled payroll. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need. Then, set up and assign a cash advance repayment.

If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need. Then, set up and assign a cash advance repayment. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. You can pay your employee in advance by running an unscheduled payroll.

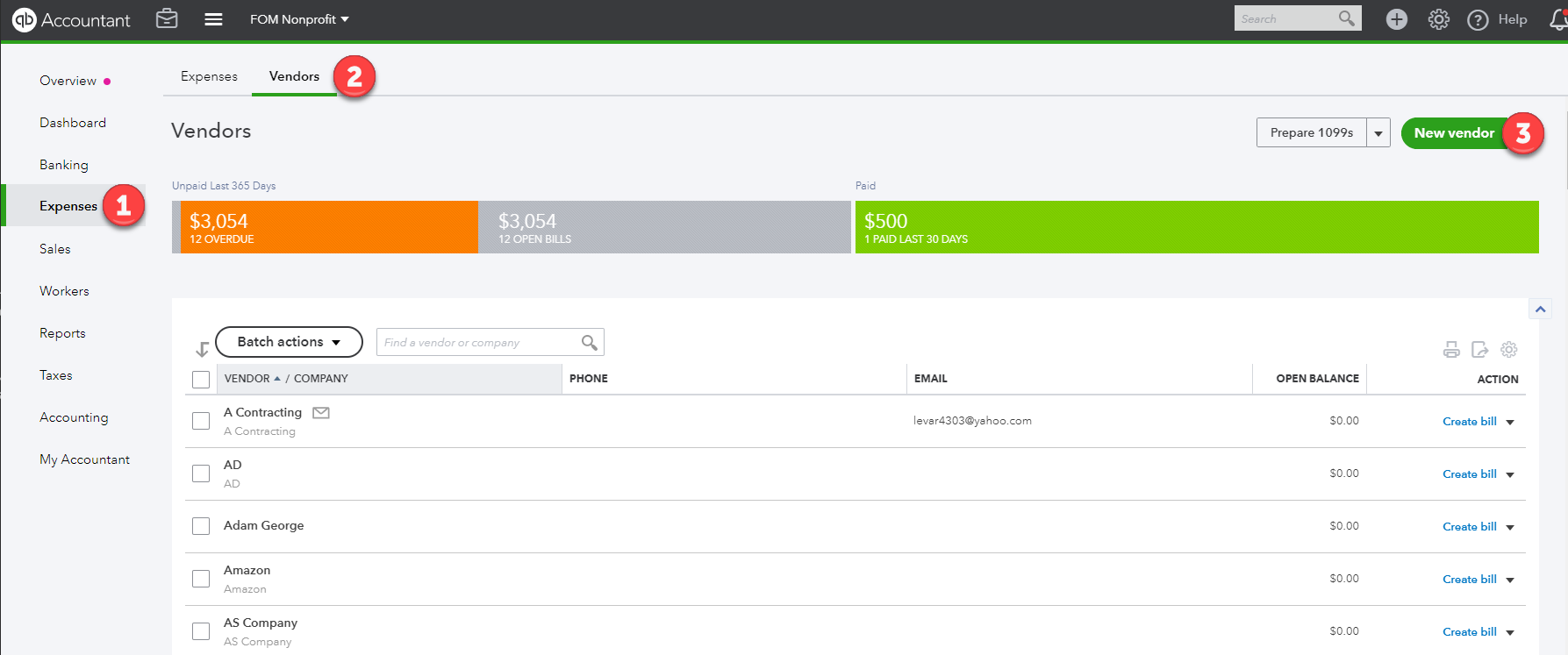

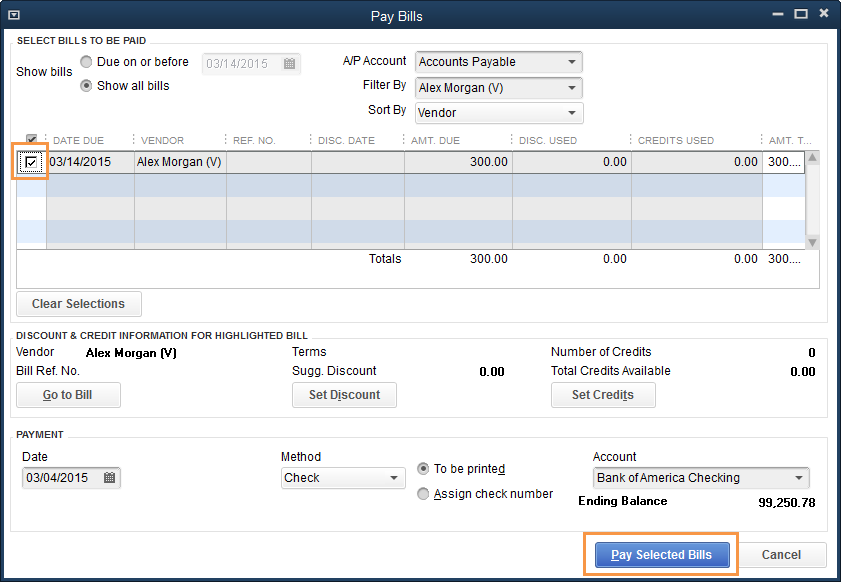

Solved Employee paid a company bill and will be reimbursed through

Then, set up and assign a cash advance repayment. You can pay your employee in advance by running an unscheduled payroll. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need.

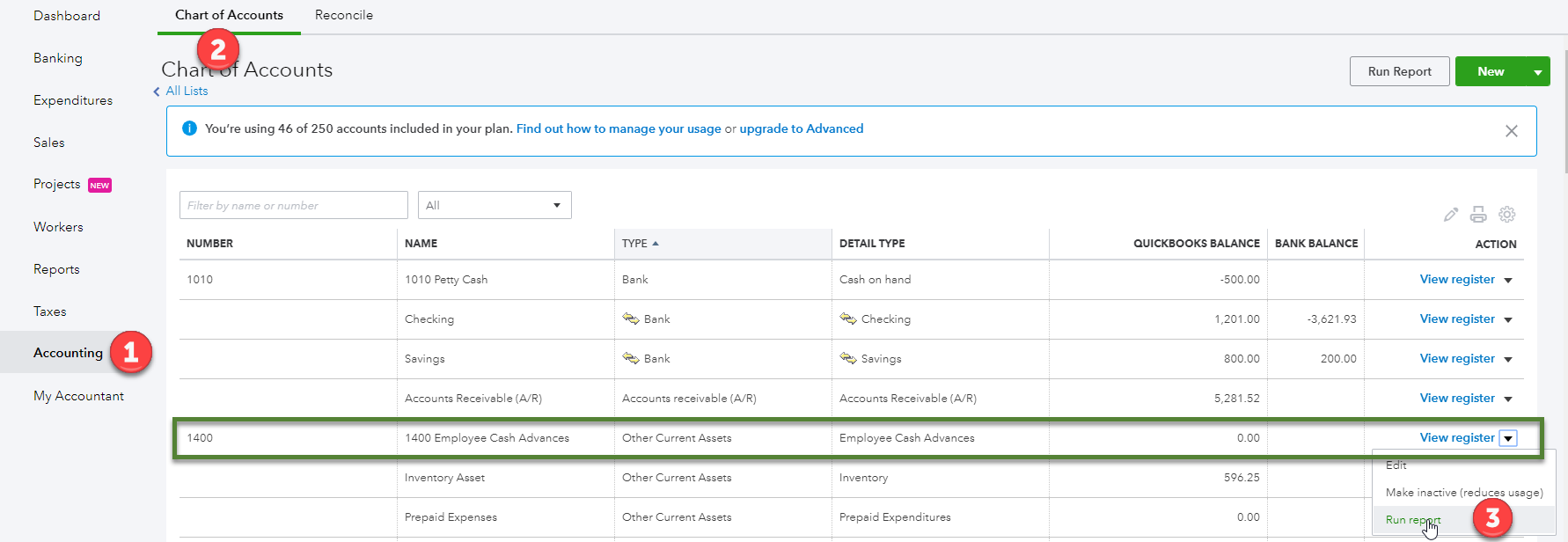

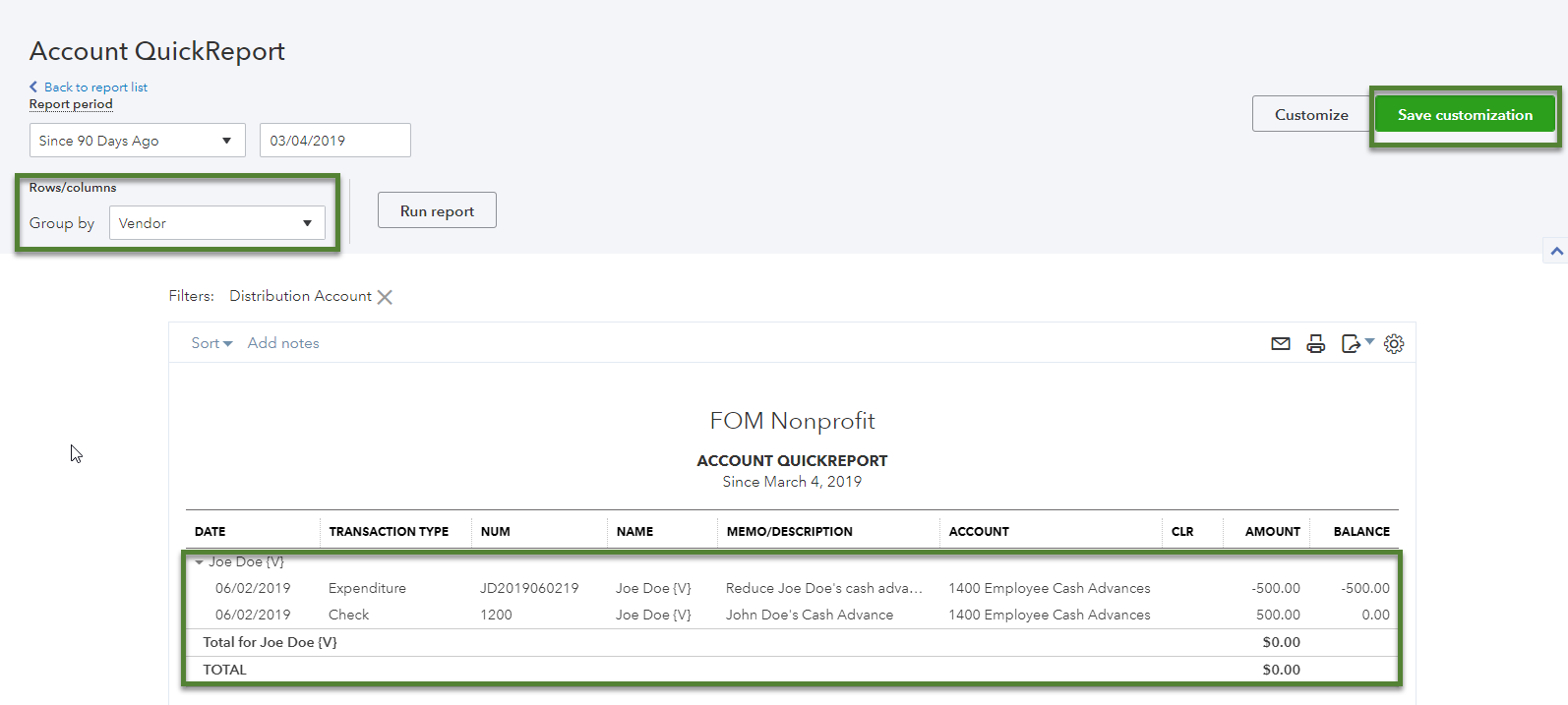

QuickBooks Online Record an Employee Cash Advance (NonPayroll Version)

You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account.

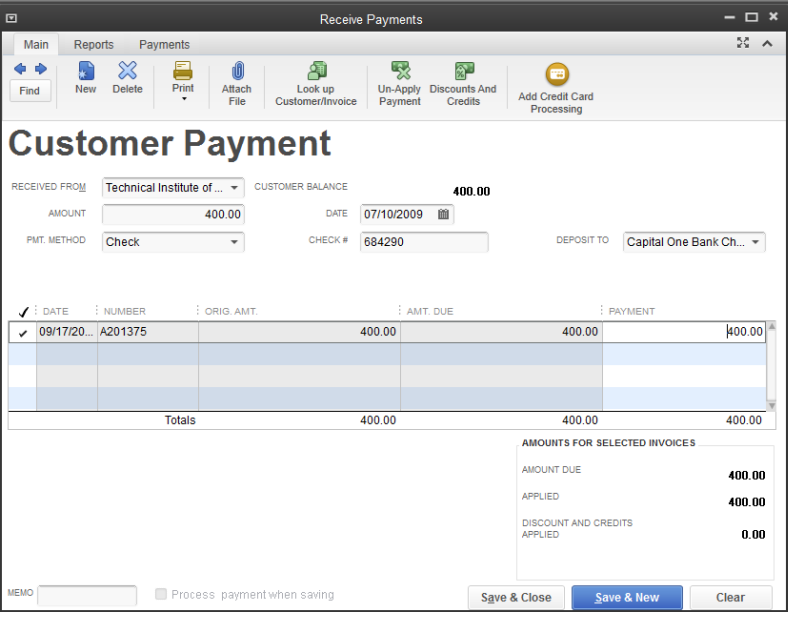

How to record a Quickbooks Cash Payment from a Customer YouTube

You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account.

Tips for Recording Cash Expenses (QuickBooks Desktop) Candus Kampfer

You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need.

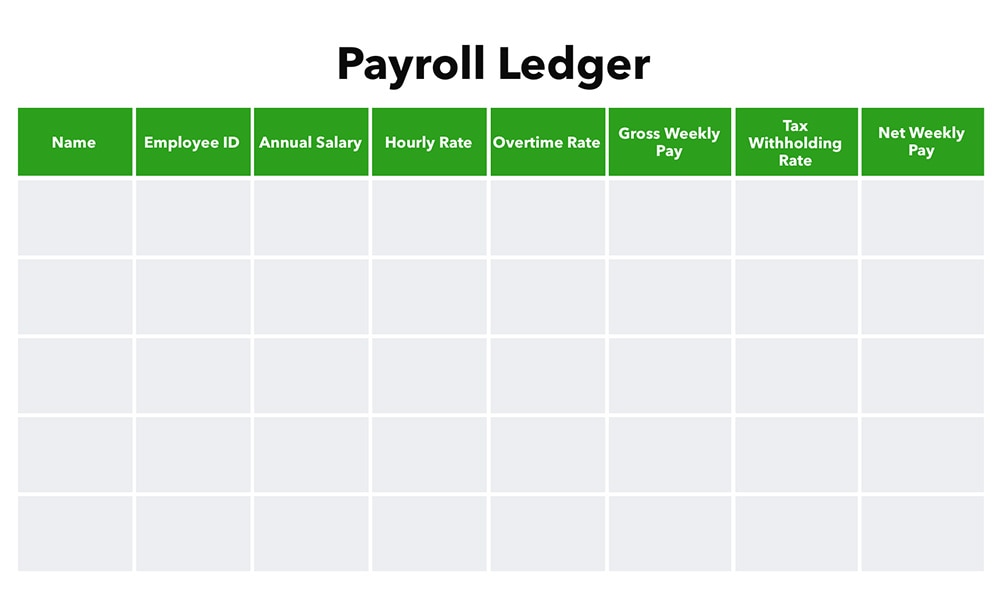

Printable Employee Payroll Ledger Template

I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need.

How to record a customer payment for an Invoice in QuickBooks

I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need.

How do i pay payroll taxes on quickbooks online

You can pay your employee in advance by running an unscheduled payroll. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need. Then, set up and assign a cash advance repayment. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account.

QuickBooks Online Record an Employee Cash Advance (NonPayroll Version)

If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment.

QuickBooks Online Record an Employee Cash Advance (NonPayroll Version)

You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need.

Using Cash Advances for QuickBooks Tallie

Then, set up and assign a cash advance repayment. If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need. You can pay your employee in advance by running an unscheduled payroll. I'm happy to help you with properly recording those payments inside your quickbooks online payroll account.

I'm Happy To Help You With Properly Recording Those Payments Inside Your Quickbooks Online Payroll Account.

If you paid for something for an employee’s personal use, with the agreement that the employee would pay you back, you’ll need. You can pay your employee in advance by running an unscheduled payroll. Then, set up and assign a cash advance repayment.