Quickbooks Online Unapplied Cash Payment Income

Quickbooks Online Unapplied Cash Payment Income - We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Search for the open invoices report. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Click reports from the left menu. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Set the date in the. Sign in to your quickbooks online account.

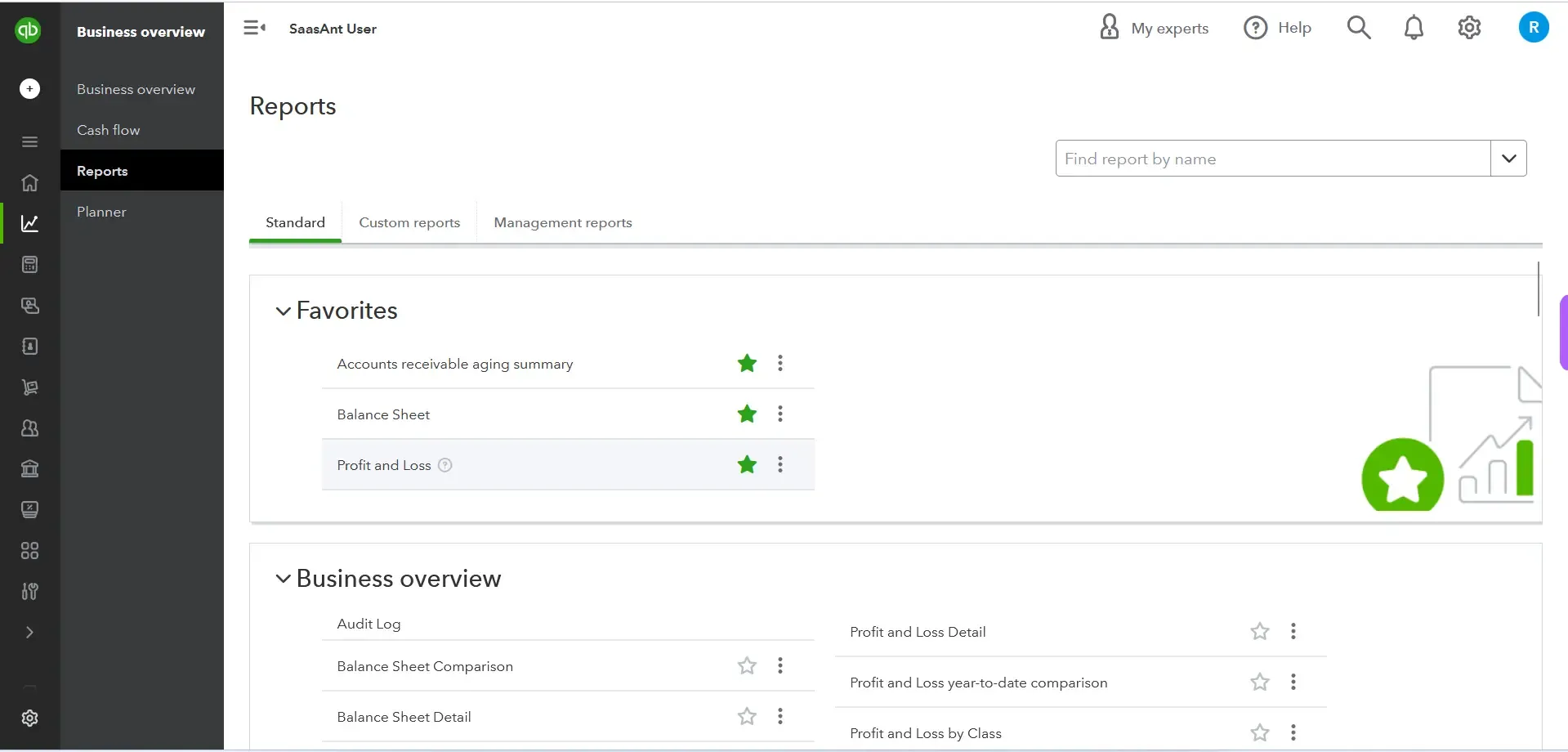

Set the date in the. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Sign in to your quickbooks online account. Search for the open invoices report. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Click reports from the left menu. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup.

Set the date in the. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Search for the open invoices report. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Sign in to your quickbooks online account. Click reports from the left menu.

How do you fix unapplied payments in QuickBooks online? TimesMojo

Search for the open invoices report. Sign in to your quickbooks online account. Set the date in the. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup.

Unapplied Cash Payment in QuickBooks Online Gentle Frog

If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Sign in to your quickbooks online account. Set the date in the. Search for the open invoices report. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify.

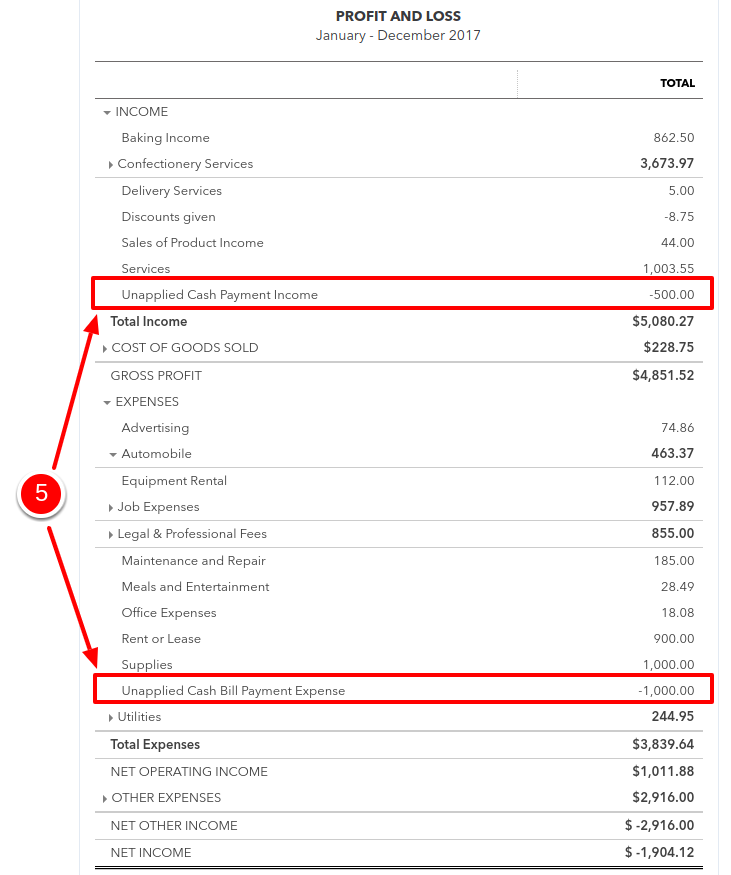

Unapplied cash payment on your profit and loss

If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Search for the open invoices report. Sign in to your quickbooks online account. Click reports from the left menu. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks.

What is Unapplied Cash Payment in QuickBooks Online?

Set the date in the. Click reports from the left menu. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Search for the open invoices report. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup.

Unapplied Cash Payment and Expenses in QuickBooks Online

Search for the open invoices report. Sign in to your quickbooks online account. Set the date in the. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. If the payment date is not within the reporting period of your profit and loss, it will be recorded as.

How to fix unapplied cash payments in QuickBooks Online 5 Minute

Click reports from the left menu. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Set the date in the. Sign in to.

Unapplied Cash Payment in QuickBooks What It Means for Your

Search for the open invoices report. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Sign in to your quickbooks online account. Set.

QuickBooks Online Cash Basis Unapplied Cash Payment

We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Set the date in the. Sign in to your quickbooks online account. Click reports from the left menu. If the payment date is not within the reporting period of your profit and loss, it will be recorded as.

Unapplied Cash Payment and Expenses in QuickBooks Online

If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Click reports from the left menu. Sign in to your quickbooks online account. Set the date in the. Search for the open invoices report.

How to clean up Unapplied Cash Payment & Expenses in QuickBooks

Click reports from the left menu. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Search for the open invoices report. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Sign in.

Search For The Open Invoices Report.

Sign in to your quickbooks online account. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Set the date in the.

We’ll Shed Light On Unapplied Cash Payment Income And Provide Actionable Insights On How To Address And Rectify This Issue Within The.

Click reports from the left menu.