How To Categorize Gifts In Quickbooks

How To Categorize Gifts In Quickbooks - In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. I received an extra amount in an invoice from a customer as a christmas gift. For personal gifts that use business inventory, here's the accounting, regardless of what platform is used: In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business. We'll cover everything from employee perks to client. Categorizing employee gifts in quickbooks involves specific steps to accurately categorize income, adhere to tax reporting requirements,. To reach them, you can follow the steps below:. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. They can also guide you through the process of entering holiday gifts for 1099 vendors.

For personal gifts that use business inventory, here's the accounting, regardless of what platform is used: I received an extra amount in an invoice from a customer as a christmas gift. They can also guide you through the process of entering holiday gifts for 1099 vendors. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. We'll cover everything from employee perks to client. To reach them, you can follow the steps below:. Categorizing employee gifts in quickbooks involves specific steps to accurately categorize income, adhere to tax reporting requirements,. In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business.

For personal gifts that use business inventory, here's the accounting, regardless of what platform is used: Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. To reach them, you can follow the steps below:. In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business. I received an extra amount in an invoice from a customer as a christmas gift. They can also guide you through the process of entering holiday gifts for 1099 vendors. We'll cover everything from employee perks to client. Categorizing employee gifts in quickbooks involves specific steps to accurately categorize income, adhere to tax reporting requirements,. In this guide, we'll dive deep into the art of categorizing gifts in quickbooks.

How To Categorize Employee Gifts In Quickbooks

They can also guide you through the process of entering holiday gifts for 1099 vendors. In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. Categorizing employee gifts in quickbooks involves specific steps to accurately categorize income, adhere to tax reporting requirements,. To reach them, you can follow the steps below:. Properly categorizing client gifts in.

How To Categorize Employee Gifts In Quickbooks

They can also guide you through the process of entering holiday gifts for 1099 vendors. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. I received an extra amount in an invoice from a customer as a christmas gift. In this guide, we'll dive deep into the art of categorizing gifts in.

How To Categorize Crypto In Quickbooks

We'll cover everything from employee perks to client. They can also guide you through the process of entering holiday gifts for 1099 vendors. I received an extra amount in an invoice from a customer as a christmas gift. In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business. To reach them, you.

How to categorize transactions in QuickBooks Online YouTube

In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. We'll cover everything from employee perks to client. In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. Categorizing employee gifts.

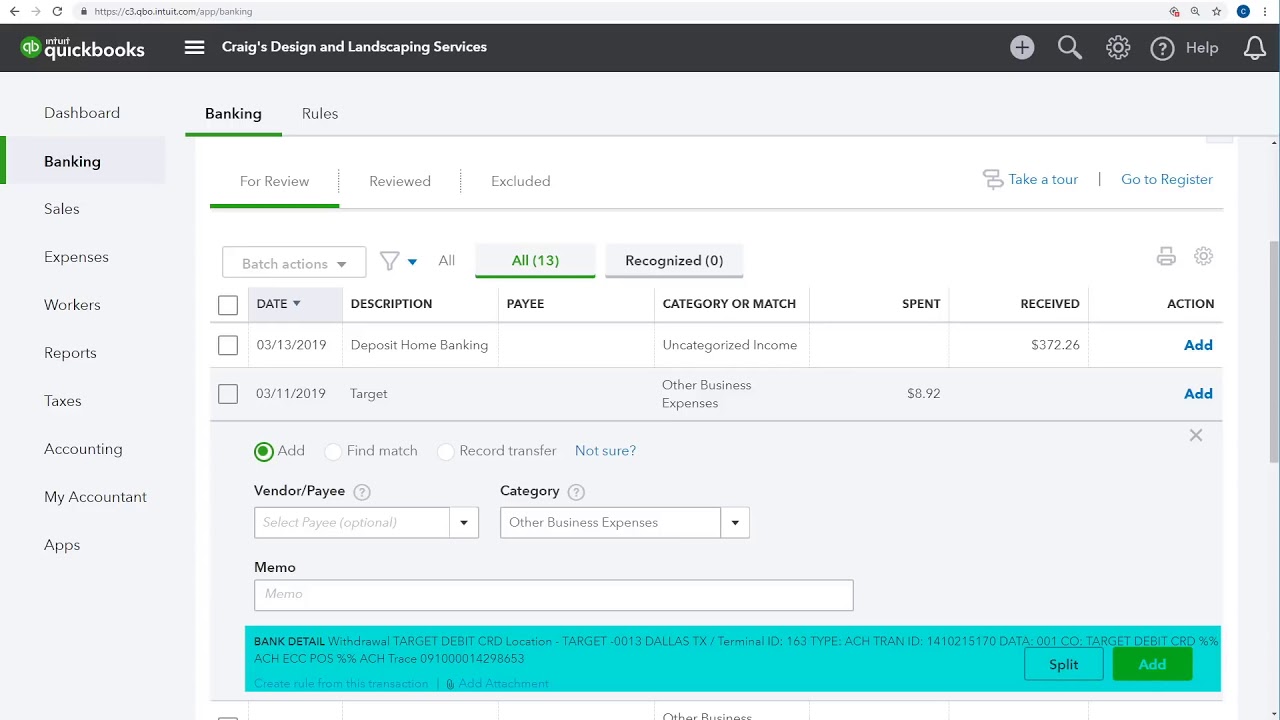

How To Categorize Expenses in QuickBooks (FAQs Guide) LiveFlow

We'll cover everything from employee perks to client. Categorizing employee gifts in quickbooks involves specific steps to accurately categorize income, adhere to tax reporting requirements,. In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business. For personal gifts that use business inventory, here's the accounting, regardless of what platform is used: Properly.

How To Categorize Employee Gifts In Quickbooks

Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. We'll cover everything from employee perks to client. They can also guide you through the process of entering holiday gifts for 1099 vendors. Categorizing employee gifts in quickbooks involves.

How to Categorize Gifts in QuickBooks

In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business. In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. To reach them, you can follow the steps below:. Categorizing employee gifts in quickbooks involves specific steps to accurately categorize income, adhere to tax reporting requirements,. They can.

QUICKBOOKS (QBO) HOW TO Categorize transactions in Bank Feeds YouTube

To reach them, you can follow the steps below:. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. For personal gifts that use business inventory, here's the accounting, regardless of what platform is used: We'll cover everything from.

How to Categorize Gifts in QuickBooks

In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business. Categorizing employee gifts in quickbooks involves specific steps to accurately categorize income, adhere to tax reporting requirements,. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. To reach them, you can follow the steps.

How to Categorize Gifts in QuickBooks

To reach them, you can follow the steps below:. They can also guide you through the process of entering holiday gifts for 1099 vendors. I received an extra amount in an invoice from a customer as a christmas gift. In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. For personal gifts that use business inventory,.

They Can Also Guide You Through The Process Of Entering Holiday Gifts For 1099 Vendors.

In quickbooks, classifying the gift expense under the name of the relevant client helps with tax compliance, business. Categorizing employee gifts in quickbooks involves specific steps to accurately categorize income, adhere to tax reporting requirements,. In this guide, we'll dive deep into the art of categorizing gifts in quickbooks. For personal gifts that use business inventory, here's the accounting, regardless of what platform is used:

To Reach Them, You Can Follow The Steps Below:.

I received an extra amount in an invoice from a customer as a christmas gift. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. We'll cover everything from employee perks to client.