How Do I Pay A Bonus In Quickbooks

How Do I Pay A Bonus In Quickbooks - You can pay your employees with bonuses along with their regular pay or through a separate paycheck. Did you remember to set up a bonus pay type for your employees? In quickbooks online, you have two options for running a bonus check. It's either creating bonuses along with the employee's. Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. If you choose to pay a. If you didn't, you won't see the bonus column when you run payroll.

If you didn't, you won't see the bonus column when you run payroll. You can pay your employees with bonuses along with their regular pay or through a separate paycheck. In quickbooks online, you have two options for running a bonus check. It's either creating bonuses along with the employee's. Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. Did you remember to set up a bonus pay type for your employees? If you choose to pay a.

If you didn't, you won't see the bonus column when you run payroll. Did you remember to set up a bonus pay type for your employees? It's either creating bonuses along with the employee's. If you choose to pay a. Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. In quickbooks online, you have two options for running a bonus check. You can pay your employees with bonuses along with their regular pay or through a separate paycheck.

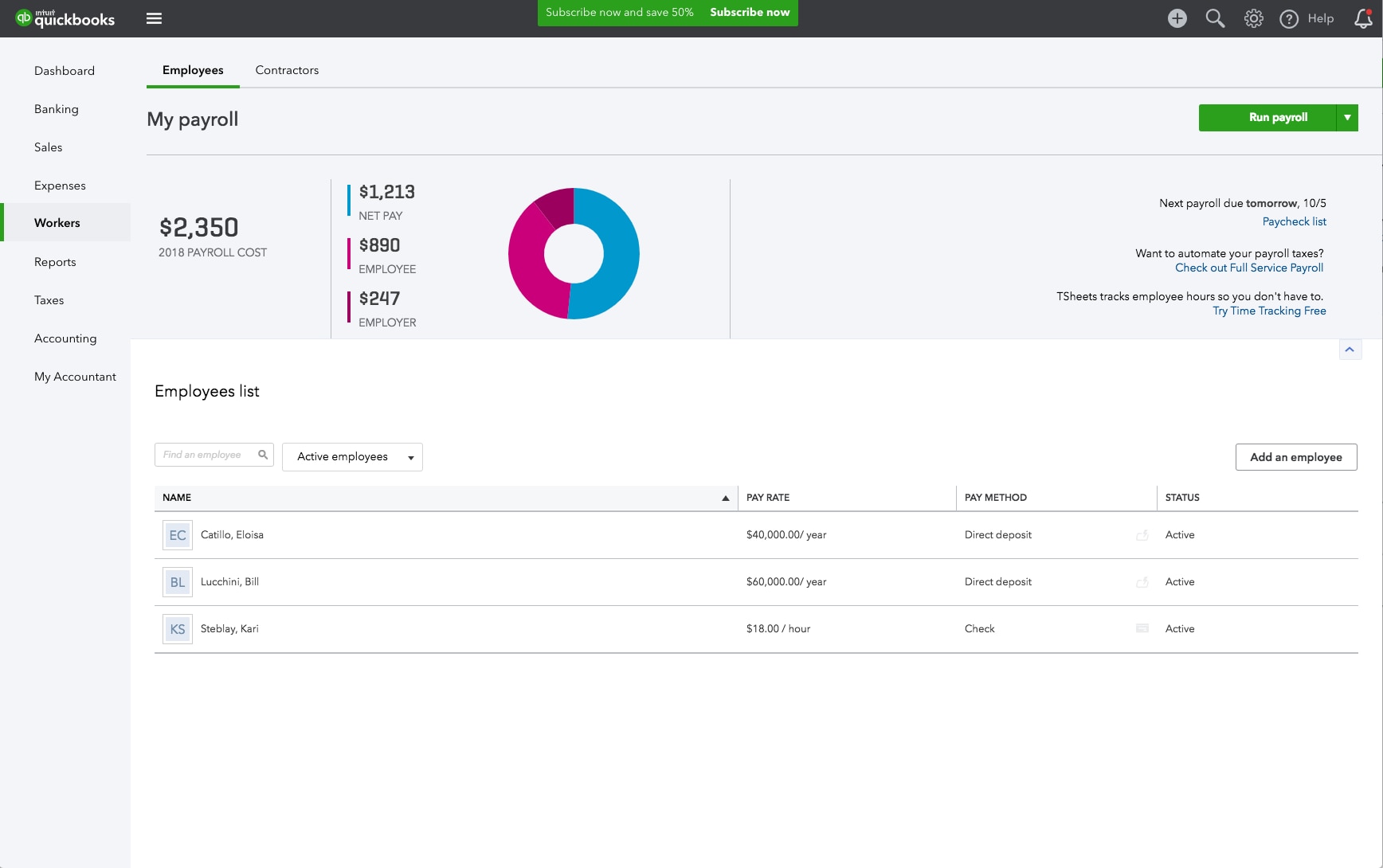

Automate Paying Payroll Taxes in QuickBooks Experts in QuickBooks

If you didn't, you won't see the bonus column when you run payroll. Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. In quickbooks online, you have two options for running a bonus check. Did you remember to set up a bonus pay type for your employees? It's either creating.

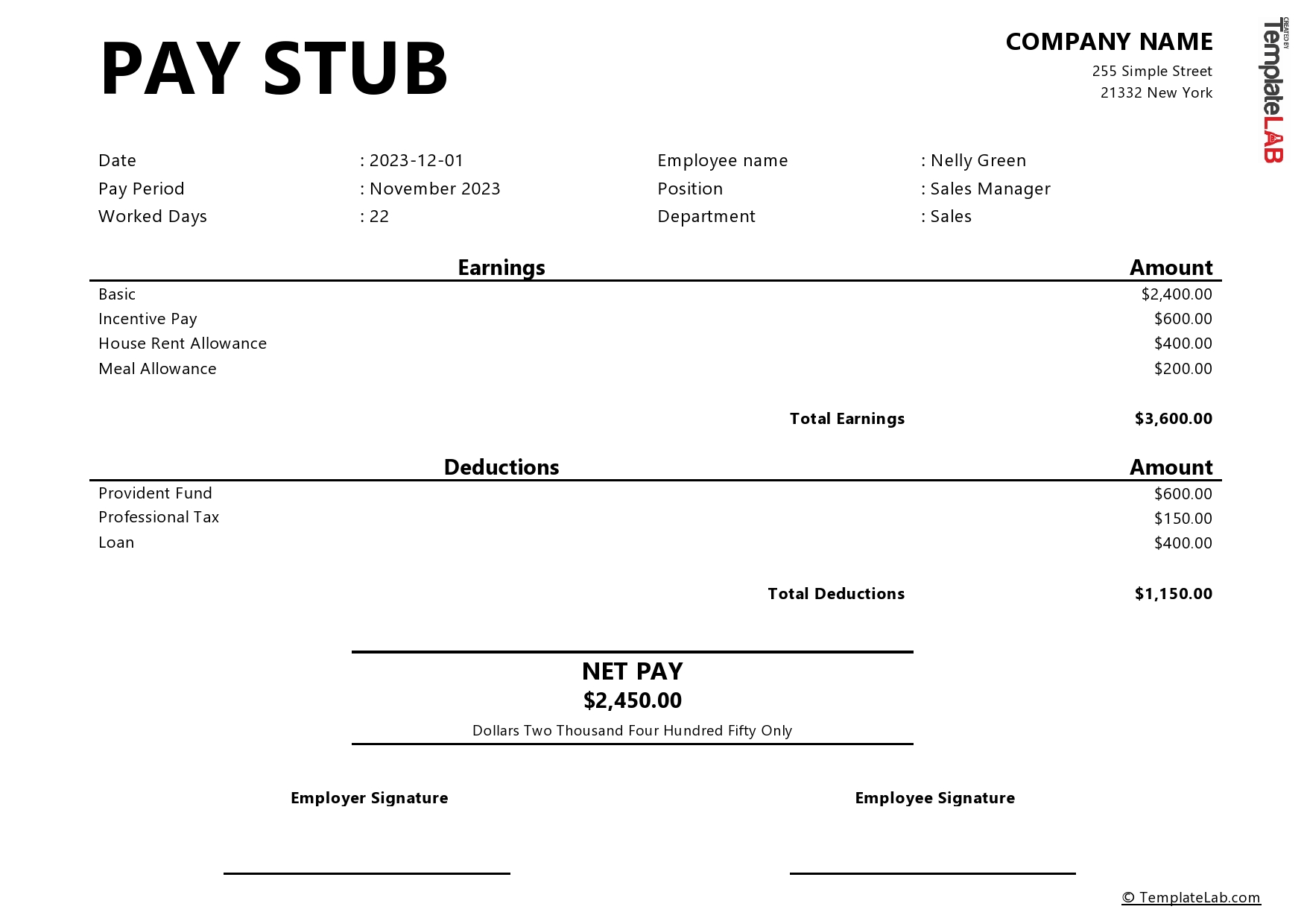

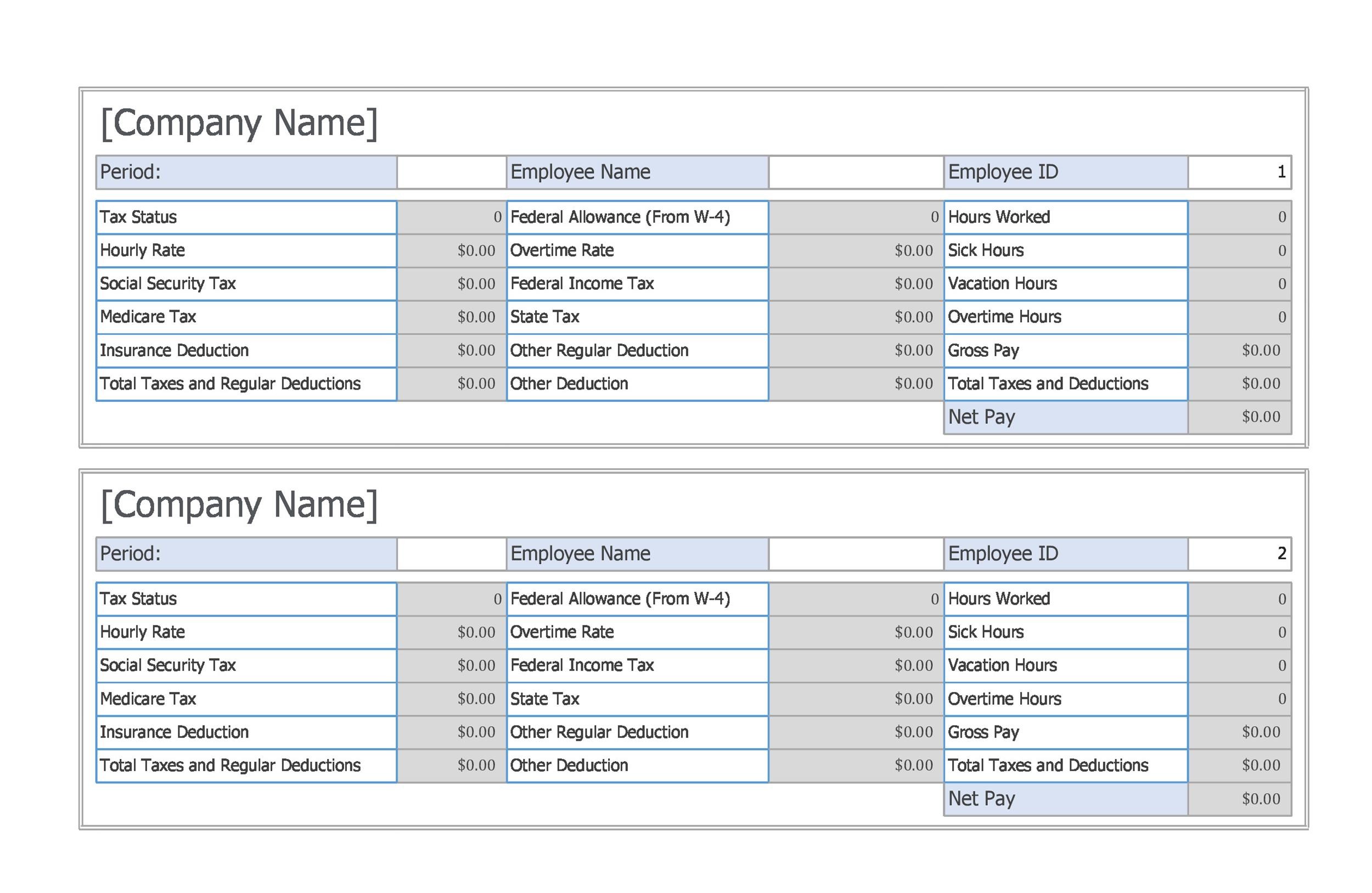

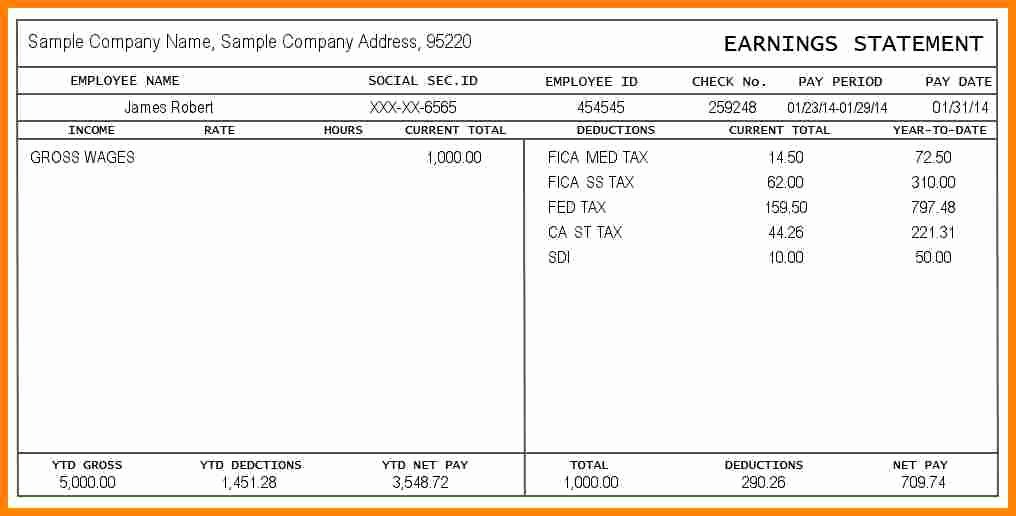

Excel Paystub Template

It's either creating bonuses along with the employee's. You can pay your employees with bonuses along with their regular pay or through a separate paycheck. In quickbooks online, you have two options for running a bonus check. Did you remember to set up a bonus pay type for your employees? Writing a bonus check in quickbooks desktop involves several steps.

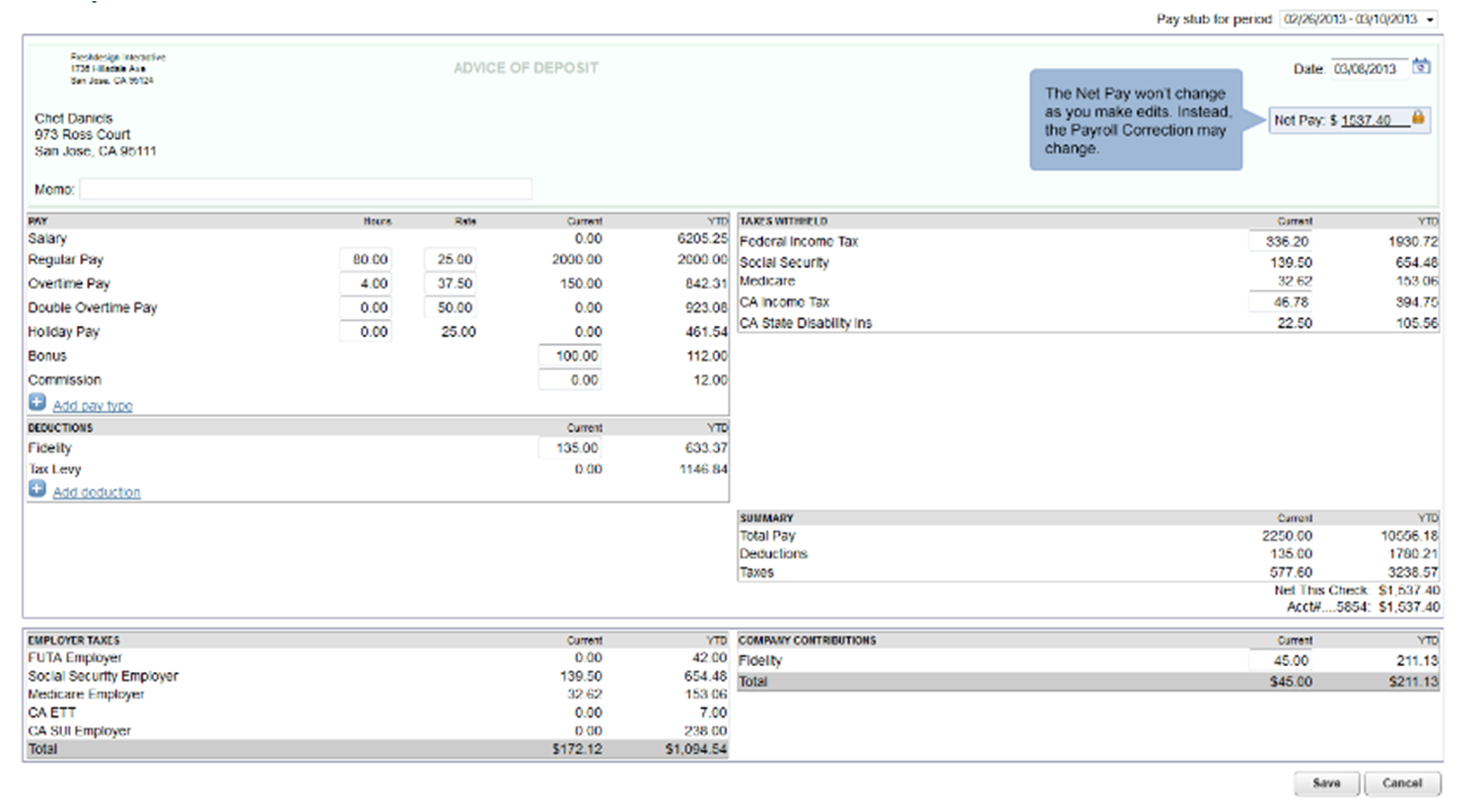

quickbooks pay stub template The Shocking Revelation of

If you choose to pay a. Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. It's either creating bonuses along with the employee's. If you didn't, you won't see the bonus column when you run payroll. You can pay your employees with bonuses along with their regular pay or through.

How do I add this bonus properly to Quickbooks payroll

If you didn't, you won't see the bonus column when you run payroll. It's either creating bonuses along with the employee's. Did you remember to set up a bonus pay type for your employees? Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. In quickbooks online, you have two options.

Create a Commission or Bonus Paycheck in QuickBooks Online

It's either creating bonuses along with the employee's. Did you remember to set up a bonus pay type for your employees? Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. If you didn't, you won't see the bonus column when you run payroll. In quickbooks online, you have two options.

How To Print PayStubs In QuickBooks Desktop, Online, & Payroll?

In quickbooks online, you have two options for running a bonus check. Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. If you didn't, you won't see the bonus column when you run payroll. Did you remember to set up a bonus pay type for your employees? It's either creating.

Quickbooks Pay Stub Template

Did you remember to set up a bonus pay type for your employees? If you didn't, you won't see the bonus column when you run payroll. Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. It's either creating bonuses along with the employee's. You can pay your employees with bonuses.

Can you do quickbooks pro with payroll codeosi

If you didn't, you won't see the bonus column when you run payroll. In quickbooks online, you have two options for running a bonus check. Did you remember to set up a bonus pay type for your employees? You can pay your employees with bonuses along with their regular pay or through a separate paycheck. Writing a bonus check in.

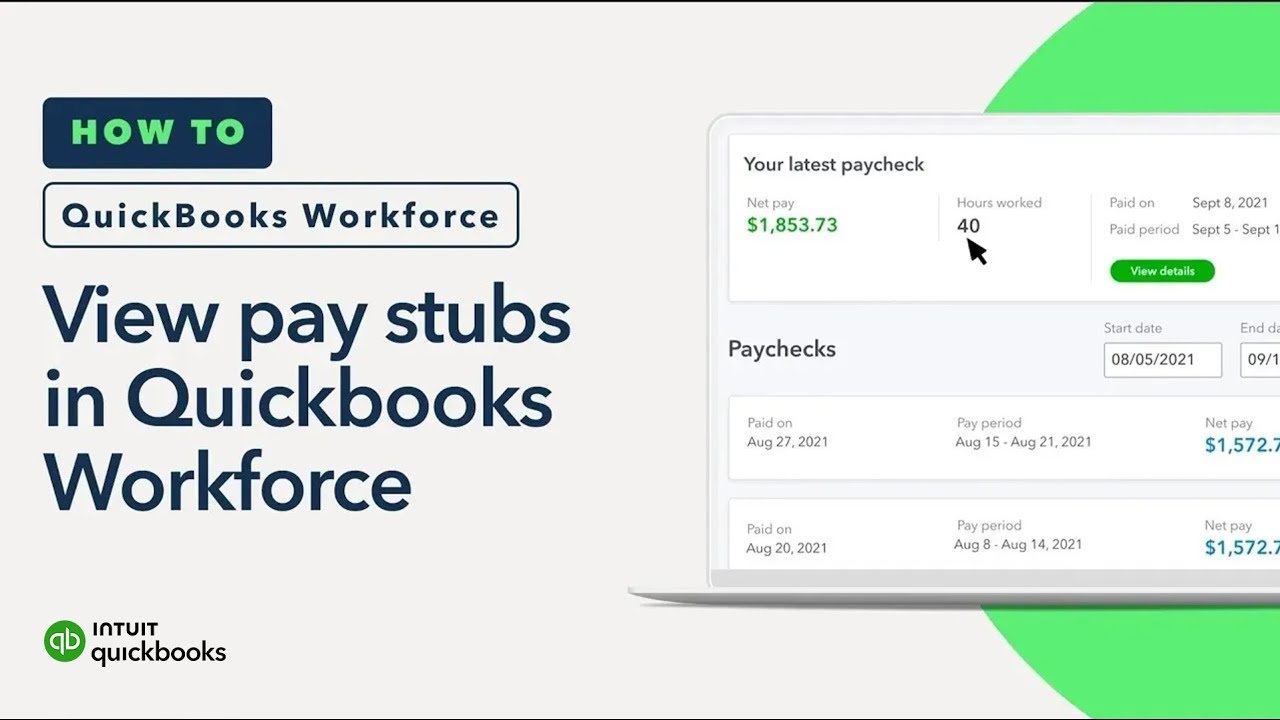

How to set up and use QuickBooks Workforce to see pay stubs and W2s

Did you remember to set up a bonus pay type for your employees? If you didn't, you won't see the bonus column when you run payroll. In quickbooks online, you have two options for running a bonus check. You can pay your employees with bonuses along with their regular pay or through a separate paycheck. Writing a bonus check in.

Quickbooks Pay Stub Template

If you didn't, you won't see the bonus column when you run payroll. Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to. In quickbooks online, you have two options for running a bonus check. It's either creating bonuses along with the employee's. You can pay your employees with bonuses along.

In Quickbooks Online, You Have Two Options For Running A Bonus Check.

If you choose to pay a. You can pay your employees with bonuses along with their regular pay or through a separate paycheck. If you didn't, you won't see the bonus column when you run payroll. It's either creating bonuses along with the employee's.

Did You Remember To Set Up A Bonus Pay Type For Your Employees?

Writing a bonus check in quickbooks desktop involves several steps to accurately process and issue the additional compensation to.