Gross Notional Exposure

Gross Notional Exposure - Under the rule, “derivatives exposure” is the sum of: We begin by considering how to determine the gross notional amount of a derivatives transaction. Gne is the sum of the absolute value of long and short exposures,. (1) the gross notional amounts of a fund’s derivatives transactions. One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. For purposes of form pf (and form adv), a hedge fund is defined to include any private fund that may have “gross notional exposure” in excess. Gross exposure is a fundamental concept in finance that every investor should understand. This post may contain our only. It refers to the total value of a. Gross notional exposure (gne) is based on sec form pf questions 26 and 30.

One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. This post may contain our only. Under the rule, “derivatives exposure” is the sum of: Gross notional exposure (gne) is based on sec form pf questions 26 and 30. Gne is the sum of the absolute value of long and short exposures,. We begin by considering how to determine the gross notional amount of a derivatives transaction. (1) the gross notional amounts of a fund’s derivatives transactions. For purposes of form pf (and form adv), a hedge fund is defined to include any private fund that may have “gross notional exposure” in excess. Gross exposure is a fundamental concept in finance that every investor should understand. It refers to the total value of a.

For purposes of form pf (and form adv), a hedge fund is defined to include any private fund that may have “gross notional exposure” in excess. Under the rule, “derivatives exposure” is the sum of: (1) the gross notional amounts of a fund’s derivatives transactions. This post may contain our only. Gross notional exposure (gne) is based on sec form pf questions 26 and 30. One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. Gne is the sum of the absolute value of long and short exposures,. We begin by considering how to determine the gross notional amount of a derivatives transaction. Gross exposure is a fundamental concept in finance that every investor should understand. It refers to the total value of a.

Finance Terms Gross Exposure Article Insider

We begin by considering how to determine the gross notional amount of a derivatives transaction. One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. (1) the gross notional amounts of a fund’s derivatives transactions. This post may contain our only. It refers to the total value of a.

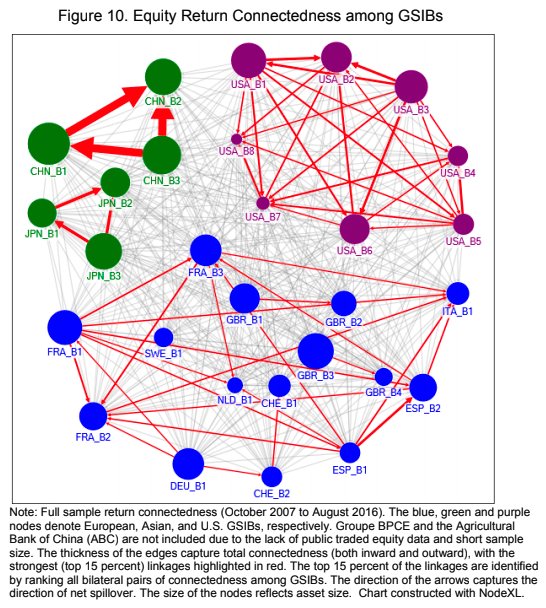

Peruvian Bull on Twitter "Credit Suisse and Deutsche Bank are Global

One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. Gne is the sum of the absolute value of long and short exposures,. Under the rule, “derivatives exposure” is the sum of: For purposes of form pf (and form adv), a hedge fund is defined to include any private fund that may have “gross.

Derivatives Exposure A Circuitous Path to “Gross Notional Amounts

One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. Gross notional exposure (gne) is based on sec form pf questions 26 and 30. Under the rule, “derivatives exposure” is the sum of: This post may contain our only. Gne is the sum of the absolute value of long and short exposures,.

Gross Notional Or Gross Error? A Misleading Metric In Credit

Gross notional exposure (gne) is based on sec form pf questions 26 and 30. Gross exposure is a fundamental concept in finance that every investor should understand. We begin by considering how to determine the gross notional amount of a derivatives transaction. It refers to the total value of a. Gne is the sum of the absolute value of long.

Gross Exposure Definition, How It Works, and Example Calculation

(1) the gross notional amounts of a fund’s derivatives transactions. Gne is the sum of the absolute value of long and short exposures,. We begin by considering how to determine the gross notional amount of a derivatives transaction. One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. Gross exposure is a fundamental concept.

Gross Exposure Definition, How It Works, and Example Calculation YouTube

Gross exposure is a fundamental concept in finance that every investor should understand. We begin by considering how to determine the gross notional amount of a derivatives transaction. Gne is the sum of the absolute value of long and short exposures,. It refers to the total value of a. Under the rule, “derivatives exposure” is the sum of:

Gross Exposure AwesomeFinTech Blog

For purposes of form pf (and form adv), a hedge fund is defined to include any private fund that may have “gross notional exposure” in excess. We begin by considering how to determine the gross notional amount of a derivatives transaction. (1) the gross notional amounts of a fund’s derivatives transactions. Gross notional exposure (gne) is based on sec form.

Derivatives Exposure A Circuitous Path to “Gross Notional Amounts

We begin by considering how to determine the gross notional amount of a derivatives transaction. For purposes of form pf (and form adv), a hedge fund is defined to include any private fund that may have “gross notional exposure” in excess. Gross exposure is a fundamental concept in finance that every investor should understand. This post may contain our only..

Gross HD Wallpapers and Backgrounds

One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. Gross exposure is a fundamental concept in finance that every investor should understand. Gne is the sum of the absolute value of long and short exposures,. Under the rule, “derivatives exposure” is the sum of: (1) the gross notional amounts of a fund’s derivatives.

Asia Pacific Financial Forum July 7, 2014 Seattle Asia Pacific

Gross exposure is a fundamental concept in finance that every investor should understand. (1) the gross notional amounts of a fund’s derivatives transactions. It refers to the total value of a. One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. Gne is the sum of the absolute value of long and short exposures,.

Gne Is The Sum Of The Absolute Value Of Long And Short Exposures,.

Gross exposure is a fundamental concept in finance that every investor should understand. We begin by considering how to determine the gross notional amount of a derivatives transaction. For purposes of form pf (and form adv), a hedge fund is defined to include any private fund that may have “gross notional exposure” in excess. (1) the gross notional amounts of a fund’s derivatives transactions.

It Refers To The Total Value Of A.

One method, the “gross method,” essentially characterizes “leverage” as the aggregate gross notional value of the. Under the rule, “derivatives exposure” is the sum of: Gross notional exposure (gne) is based on sec form pf questions 26 and 30. This post may contain our only.