Duolingo Value

Duolingo Value - Enterprise value, p/e ratio, peg, fcf, and many other ratios. Find out all the key statistics for duolingo, inc. The projected fair value for duolingo is us$383 based on 2 stage free cash flow to equity. The average price target for duolingo is $362.67, which is 6.55% higher than the current price. Find the latest duolingo, inc. Find analyst estimates regarding the valuation of duolingo, inc. Duolingo has a market cap or net worth of $14.99 billion as of december 24, 2024. (duol), including valuation measures, fiscal year financial statistics, trading record, share. Its market cap has increased by 66.19% in one. (duol) stock quote, history, news and other vital information to help you with your stock trading and investing.

Find analyst estimates regarding the valuation of duolingo, inc. See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help you make your. Its market cap has increased by 66.19% in one. Find the latest duolingo, inc. Current share price of us$354. (duol), including valuation measures, fiscal year financial statistics, trading record, share. (duol) stock quote, history, news and other vital information to help you with your stock trading and investing. Find out all the key statistics for duolingo, inc. The projected fair value for duolingo is us$383 based on 2 stage free cash flow to equity. Enterprise value, p/e ratio, peg, fcf, and many other ratios.

The average price target for duolingo is $362.67, which is 6.55% higher than the current price. Duolingo has a market cap or net worth of $14.99 billion as of december 24, 2024. Its market cap has increased by 66.19% in one. (duol), including valuation measures, fiscal year financial statistics, trading record, share. Find analyst estimates regarding the valuation of duolingo, inc. The consensus rating is buy. The projected fair value for duolingo is us$383 based on 2 stage free cash flow to equity. Enterprise value, p/e ratio, peg, fcf, and many other ratios. Current share price of us$354. Find out all the key statistics for duolingo, inc.

Value propositions at Duolingo 68 of 69

The consensus rating is buy. See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help you make your. The projected fair value for duolingo is us$383 based on 2 stage free cash flow to equity. Find out all the key statistics for duolingo, inc. Find the latest duolingo, inc.

Duolingo Price & PromotionJul 2024BigGo Malaysia

Duolingo has a market cap or net worth of $14.99 billion as of december 24, 2024. Its market cap has increased by 66.19% in one. Find analyst estimates regarding the valuation of duolingo, inc. The average price target for duolingo is $362.67, which is 6.55% higher than the current price. Current share price of us$354.

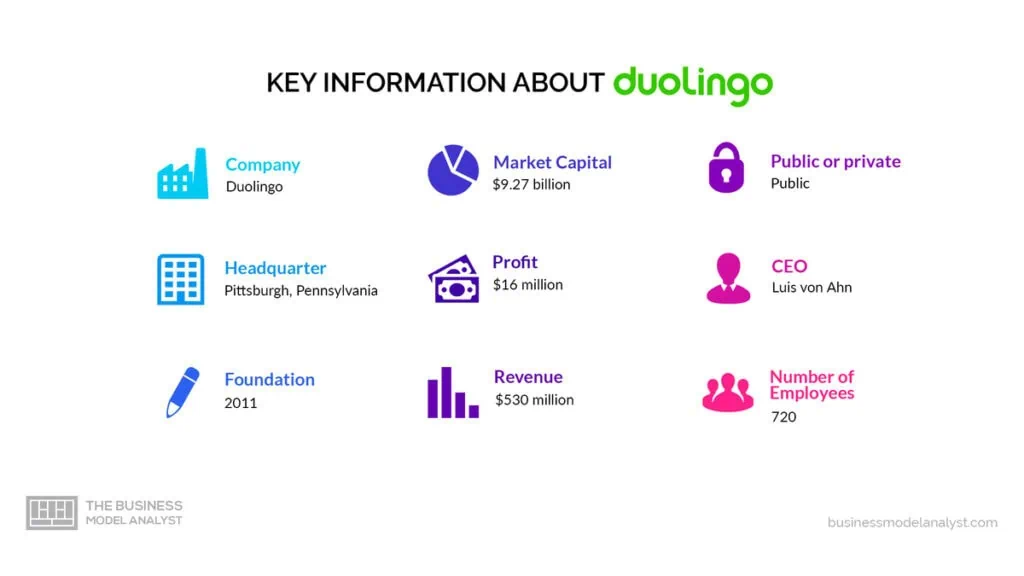

Duolingo Business Model in Education Technology

Find analyst estimates regarding the valuation of duolingo, inc. Current share price of us$354. (duol), including valuation measures, fiscal year financial statistics, trading record, share. Find out all the key statistics for duolingo, inc. The consensus rating is buy.

Super Duolingo Review (UPDATED 2024) Is The Premium Tier Worth It

(duol) stock quote, history, news and other vital information to help you with your stock trading and investing. The consensus rating is buy. Find out all the key statistics for duolingo, inc. (duol), including valuation measures, fiscal year financial statistics, trading record, share. The projected fair value for duolingo is us$383 based on 2 stage free cash flow to equity.

Super Duolingo Cost in 2023 Is Premium Worth it? Studying Hood

Enterprise value, p/e ratio, peg, fcf, and many other ratios. Current share price of us$354. Duolingo has a market cap or net worth of $14.99 billion as of december 24, 2024. Find out all the key statistics for duolingo, inc. See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help you make your.

How Much Does Super Duolingo Cost? Exploring the Value of Investing in

Find out all the key statistics for duolingo, inc. Duolingo has a market cap or net worth of $14.99 billion as of december 24, 2024. See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help you make your. (duol) stock quote, history, news and other vital information to help you with your stock trading.

Duolingo Business Model How Duolingo Makes Money?

(duol) stock quote, history, news and other vital information to help you with your stock trading and investing. The average price target for duolingo is $362.67, which is 6.55% higher than the current price. Find the latest duolingo, inc. The consensus rating is buy. See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help.

Duolingo like app development cost

Duolingo has a market cap or net worth of $14.99 billion as of december 24, 2024. Its market cap has increased by 66.19% in one. Enterprise value, p/e ratio, peg, fcf, and many other ratios. See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help you make your. The average price target for duolingo.

What Is The Difference Between Free Duolingo And Duolingo Plus at Dylan

Duolingo has a market cap or net worth of $14.99 billion as of december 24, 2024. The consensus rating is buy. Find the latest duolingo, inc. Current share price of us$354. See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help you make your.

How Does Duolingo Make Money? Duolingo Business Model In A Nutshell

See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help you make your. The projected fair value for duolingo is us$383 based on 2 stage free cash flow to equity. Its market cap has increased by 66.19% in one. Find analyst estimates regarding the valuation of duolingo, inc. The average price target for duolingo.

Duolingo Has A Market Cap Or Net Worth Of $14.99 Billion As Of December 24, 2024.

Current share price of us$354. Find out all the key statistics for duolingo, inc. The projected fair value for duolingo is us$383 based on 2 stage free cash flow to equity. Find analyst estimates regarding the valuation of duolingo, inc.

Its Market Cap Has Increased By 66.19% In One.

The consensus rating is buy. (duol) stock quote, history, news and other vital information to help you with your stock trading and investing. Find the latest duolingo, inc. See the latest duolingo inc stock price (duol:xnas), related news, valuation, dividends and more to help you make your.

Enterprise Value, P/E Ratio, Peg, Fcf, And Many Other Ratios.

The average price target for duolingo is $362.67, which is 6.55% higher than the current price. (duol), including valuation measures, fiscal year financial statistics, trading record, share.