Does Shopify Pay Sales Tax For Me

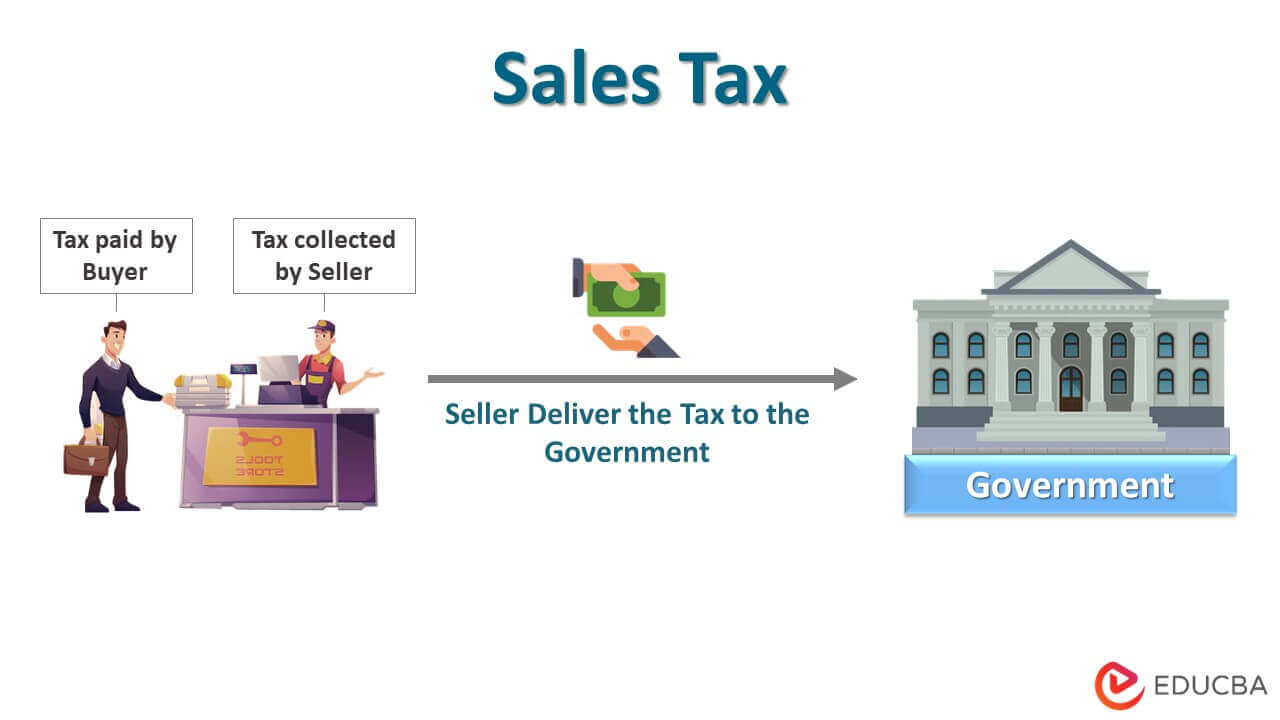

Does Shopify Pay Sales Tax For Me - Shopify tax is free on your first $100,000 of us sales each calendar year. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. Use shopify tax to track sales, file reports, and apply tax rates with smart categorization. This complete guide breaks down basic tax information for shopify sellers. Shopify taxes might seem overwhelming at first, but we’ve got you covered. Missing sales tax requirements can have serious consequences. Shopify tax is a sales tax tool for merchants selling in the us. As your business grows, you need to have a sales tax permit for every state you’re selling into. If you are liable to pay sales tax in your state, then it is up to you as. After $100,000, a 0.35% calculation fee (0.25% for shopify plus merchants) will be charged on orders in states where tax.

Shopify tax is a sales tax tool for merchants selling in the us. If you are liable to pay sales tax in your state, then it is up to you as. Shopify tax is free on your first $100,000 of us sales each calendar year. Shopify taxes might seem overwhelming at first, but we’ve got you covered. Missing sales tax requirements can have serious consequences. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. This complete guide breaks down basic tax information for shopify sellers. After $100,000, a 0.35% calculation fee (0.25% for shopify plus merchants) will be charged on orders in states where tax. As your business grows, you need to have a sales tax permit for every state you’re selling into. Use shopify tax to track sales, file reports, and apply tax rates with smart categorization.

This complete guide breaks down basic tax information for shopify sellers. Shopify tax is free on your first $100,000 of us sales each calendar year. Use shopify tax to track sales, file reports, and apply tax rates with smart categorization. Shopify taxes might seem overwhelming at first, but we’ve got you covered. After $100,000, a 0.35% calculation fee (0.25% for shopify plus merchants) will be charged on orders in states where tax. If you are liable to pay sales tax in your state, then it is up to you as. Shopify tax is a sales tax tool for merchants selling in the us. Missing sales tax requirements can have serious consequences. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. As your business grows, you need to have a sales tax permit for every state you’re selling into.

Does Shopify Collect Sales Tax (Guide & How to Collect)

As your business grows, you need to have a sales tax permit for every state you’re selling into. After $100,000, a 0.35% calculation fee (0.25% for shopify plus merchants) will be charged on orders in states where tax. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. Shopify taxes.

What Is Shopify And How Does It Work Forbes Advisor Australia

Missing sales tax requirements can have serious consequences. This complete guide breaks down basic tax information for shopify sellers. If you are liable to pay sales tax in your state, then it is up to you as. After $100,000, a 0.35% calculation fee (0.25% for shopify plus merchants) will be charged on orders in states where tax. Shopify tax is.

50 Really Good Shopify Website Examples that Sell with Ease RGD

If you are liable to pay sales tax in your state, then it is up to you as. Shopify taxes might seem overwhelming at first, but we’ve got you covered. After $100,000, a 0.35% calculation fee (0.25% for shopify plus merchants) will be charged on orders in states where tax. Shopify tax is free on your first $100,000 of us.

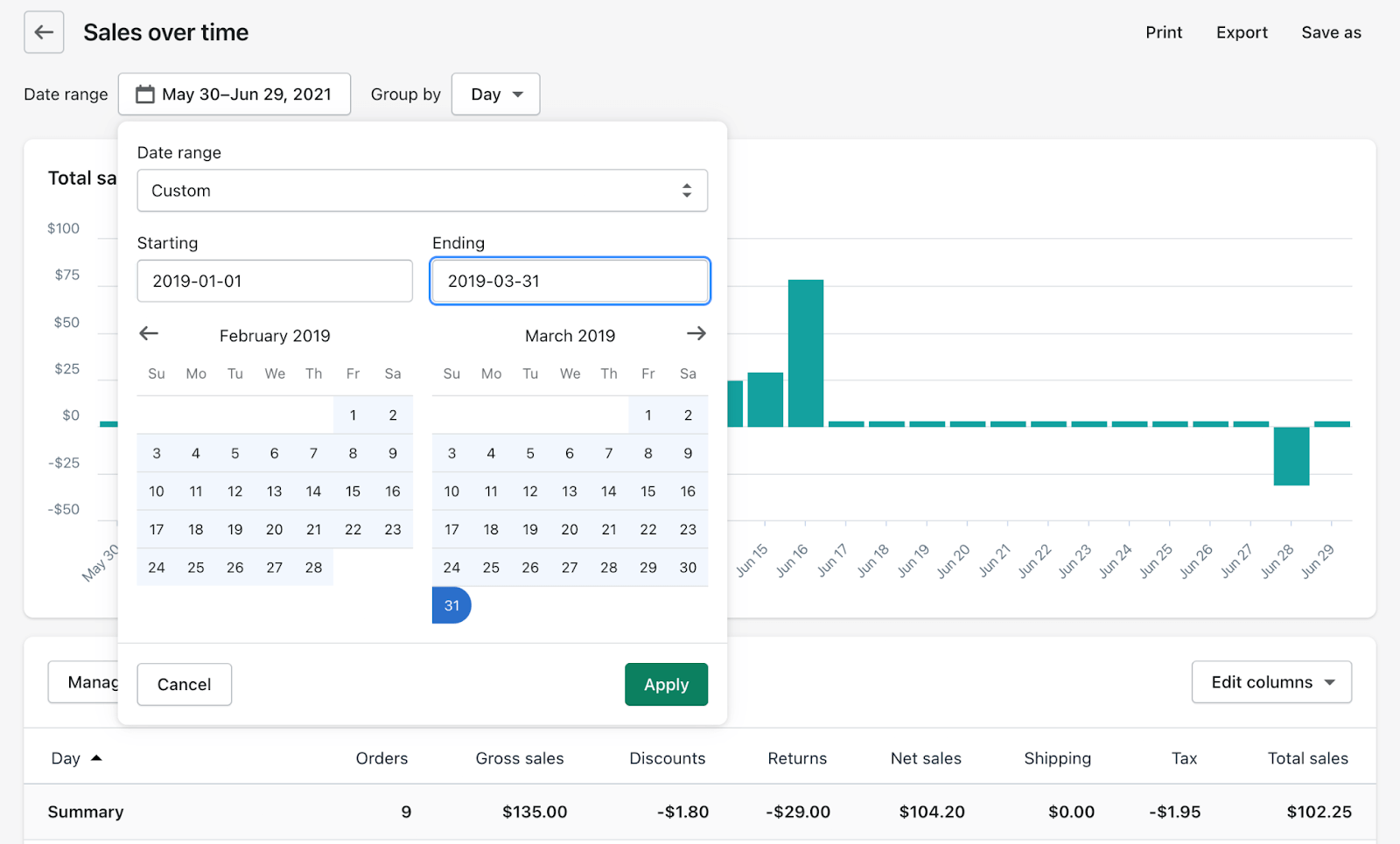

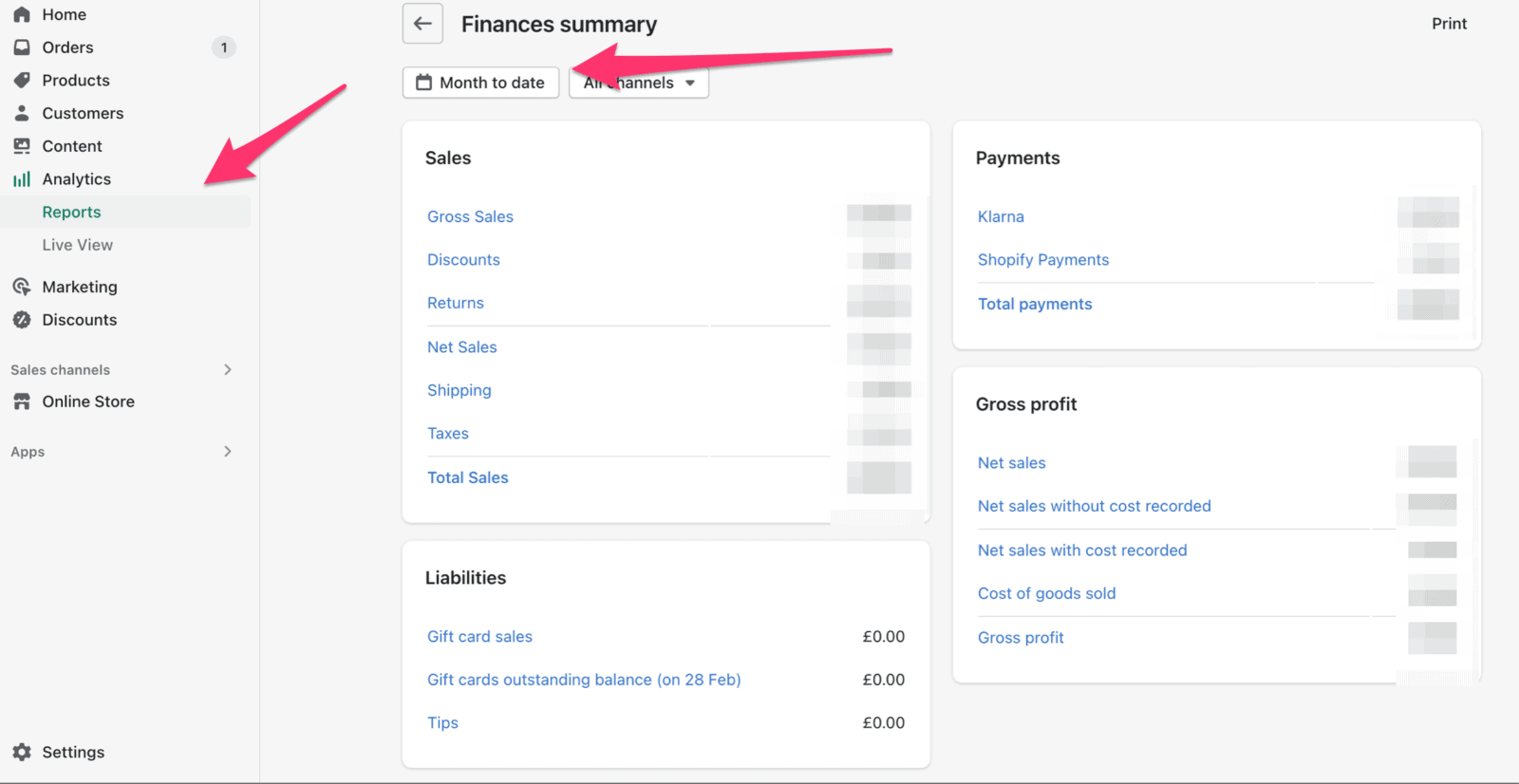

The Ultimate Guide to Shopify Reports Coupler.io Blog

Use shopify tax to track sales, file reports, and apply tax rates with smart categorization. Missing sales tax requirements can have serious consequences. After $100,000, a 0.35% calculation fee (0.25% for shopify plus merchants) will be charged on orders in states where tax. Shopify tax is free on your first $100,000 of us sales each calendar year. Shopify taxes might.

27+ Return Survival Chapter 1 RoanVanshika

Missing sales tax requirements can have serious consequences. Use shopify tax to track sales, file reports, and apply tax rates with smart categorization. Shopify tax is a sales tax tool for merchants selling in the us. If you are liable to pay sales tax in your state, then it is up to you as. Shopify tax is free on your.

How Often Does Shopify Pay Out? Digital Cornerstone

Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. Missing sales tax requirements can have serious consequences. Shopify tax is a sales tax tool for merchants selling in the us. Shopify taxes might seem overwhelming at first, but we’ve got you covered. Shopify tax is free on your first.

Does Shopify Collect Sales Tax (Guide & How to Collect)

As your business grows, you need to have a sales tax permit for every state you’re selling into. After $100,000, a 0.35% calculation fee (0.25% for shopify plus merchants) will be charged on orders in states where tax. If you are liable to pay sales tax in your state, then it is up to you as. Use shopify tax to.

Does Shopify Collect Sales Tax (Guide & How to Collect)

As your business grows, you need to have a sales tax permit for every state you’re selling into. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. Shopify tax is a sales tax tool for merchants selling in the us. Shopify taxes might seem overwhelming at first, but we’ve.

Does Shopify Collect Sales Tax (Guide & How to Collect)

Shopify taxes might seem overwhelming at first, but we’ve got you covered. As your business grows, you need to have a sales tax permit for every state you’re selling into. If you are liable to pay sales tax in your state, then it is up to you as. Shopify tax is free on your first $100,000 of us sales each.

Does Shopify Collect Sales Tax? What You Need To Know

Shopify taxes might seem overwhelming at first, but we’ve got you covered. If you are liable to pay sales tax in your state, then it is up to you as. Shopify tax is a sales tax tool for merchants selling in the us. As your business grows, you need to have a sales tax permit for every state you’re selling.

After $100,000, A 0.35% Calculation Fee (0.25% For Shopify Plus Merchants) Will Be Charged On Orders In States Where Tax.

As your business grows, you need to have a sales tax permit for every state you’re selling into. Missing sales tax requirements can have serious consequences. This complete guide breaks down basic tax information for shopify sellers. If you are liable to pay sales tax in your state, then it is up to you as.

Shopify Tax Is A Sales Tax Tool For Merchants Selling In The Us.

Use shopify tax to track sales, file reports, and apply tax rates with smart categorization. Shopify taxes might seem overwhelming at first, but we’ve got you covered. Shopify tax is free on your first $100,000 of us sales each calendar year. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf.