Depreciation Schedule Quickbooks

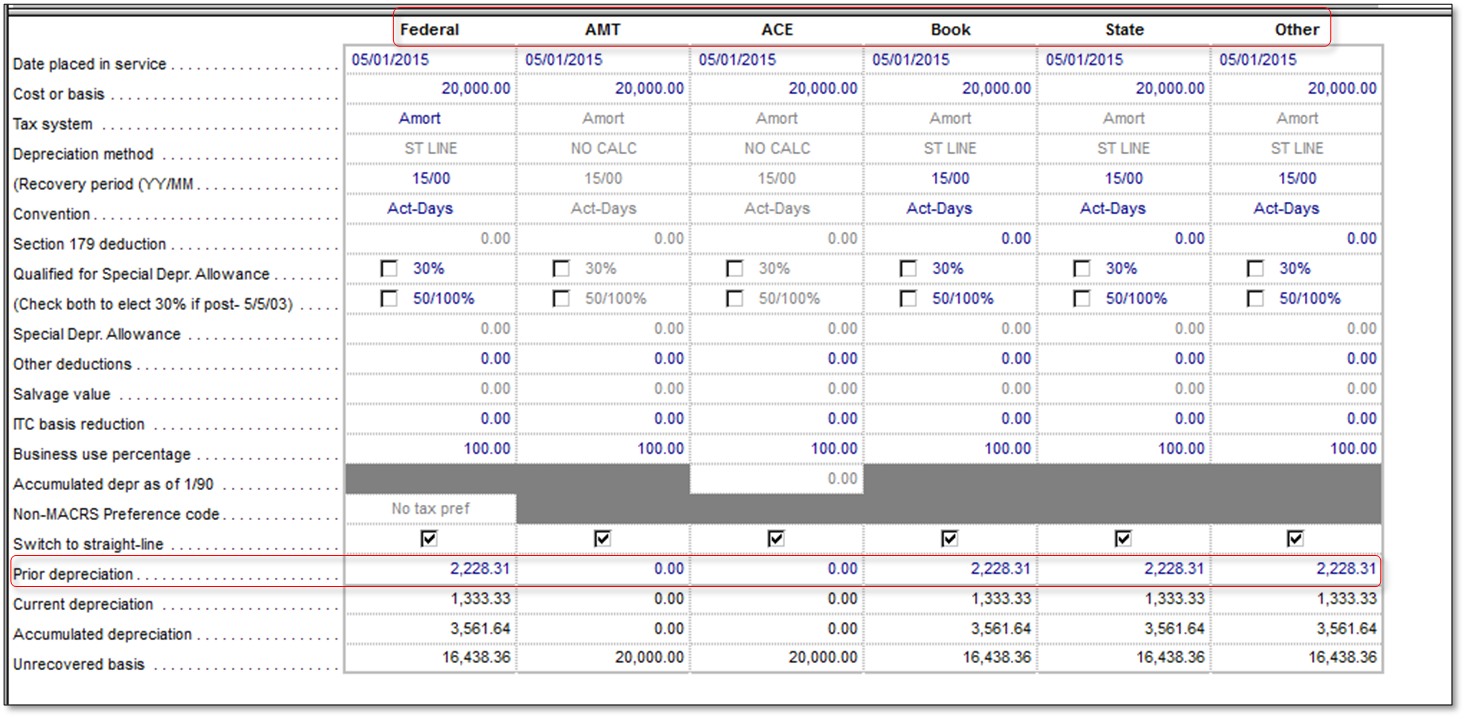

Depreciation Schedule Quickbooks - Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. The availability of this feature is only. In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit fixed. Let me share info about adding a depreciation schedule in quickbooks online (qbo). Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount.

Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. Let me share info about adding a depreciation schedule in quickbooks online (qbo). Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit fixed. The availability of this feature is only.

The availability of this feature is only. Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. Let me share info about adding a depreciation schedule in quickbooks online (qbo). In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit fixed. Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and.

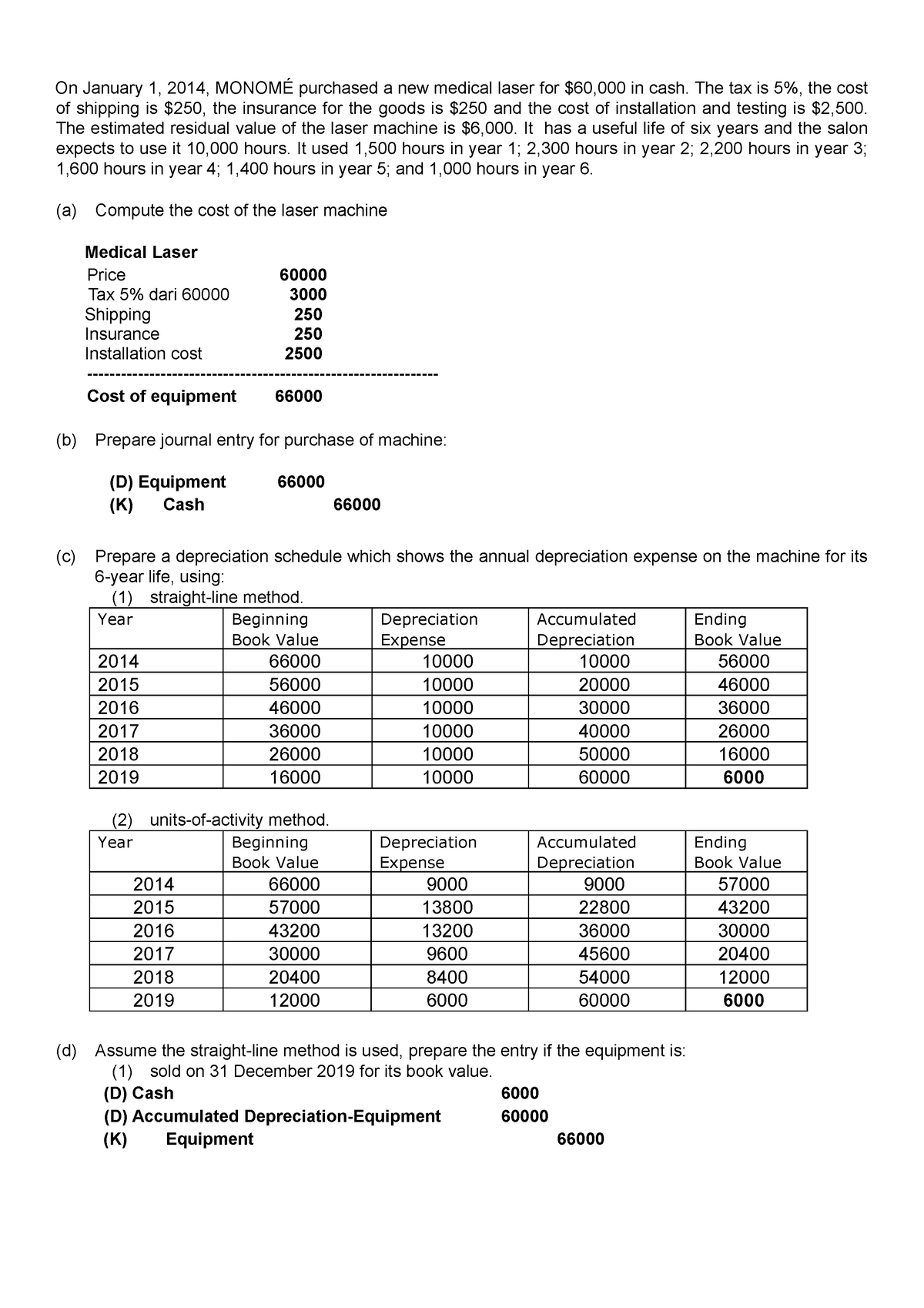

Tutorial ACC QUIZ 5 (c) Prepare a depreciation schedule which shows

Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. Let me share info about adding a depreciation schedule in quickbooks online (qbo). Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. The availability of this feature is only. In this guide, we’ll go over how.

Calculation of depreciation on rental property InnesLockie

Let me share info about adding a depreciation schedule in quickbooks online (qbo). Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. The availability of this feature is only. In this guide, we’ll go over how.

How to prepare depreciation schedule in excel YouTube

The availability of this feature is only. Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit fixed. Quickbooks uses the purchase date, useful life, and depreciation method to.

Fixed Asset Depreciation Schedule Excel Excel Templates

Let me share info about adding a depreciation schedule in quickbooks online (qbo). Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. In this guide, we’ll go over how to use the quickbooks online fixed asset.

How to record Depreciation and Accumulated Depreciation in QuickBooks

Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. The availability of this feature is only. In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit fixed. Let me share info about adding a depreciation schedule in quickbooks.

Depreciation Schedule Guide & Example QuickBooks Australia

Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. Let me share info about adding a depreciation schedule in quickbooks online (qbo). In this guide, we’ll go over how to use the quickbooks online fixed asset.

野並駅(ノナミ)のタクシー乗り場情報をタクドラが徹底解説 たくのり

Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. The availability of this feature is only. Let me share info about adding a depreciation schedule in quickbooks online (qbo). In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit.

Depreciation Schedule Guide, Example of How to Create a Schedule

In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit fixed. Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. Let me.

What is a Depreciation Schedule and Why do you need one? DMA

Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit fixed. The availability.

Depreciation Schedule Template Straight Line Calculator Diminishing

Let me share info about adding a depreciation schedule in quickbooks online (qbo). Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount. In this guide, we’ll go over how to use the quickbooks online fixed asset manager by showing you how you can add and edit fixed. The availability of this feature is.

In This Guide, We’ll Go Over How To Use The Quickbooks Online Fixed Asset Manager By Showing You How You Can Add And Edit Fixed.

Accounting depreciation in quickbooks involves a series of steps, which when followed makes setting up, recording, and. The availability of this feature is only. Let me share info about adding a depreciation schedule in quickbooks online (qbo). Quickbooks uses the purchase date, useful life, and depreciation method to calculate the accumulated depreciation amount.