Airbnb Taxable Income

Airbnb Taxable Income - Taxable rental income is the gross amount of rent received less any allowable expenses. This can also be referred to as ‘net’ rental income.

This can also be referred to as ‘net’ rental income. Taxable rental income is the gross amount of rent received less any allowable expenses.

Taxable rental income is the gross amount of rent received less any allowable expenses. This can also be referred to as ‘net’ rental income.

Airbnb Side Hustle Ideas For Extra 4 Proven Ways

This can also be referred to as ‘net’ rental income. Taxable rental income is the gross amount of rent received less any allowable expenses.

Airbnb Revenue Estimate How to Calculate Mashvisor

This can also be referred to as ‘net’ rental income. Taxable rental income is the gross amount of rent received less any allowable expenses.

Is my Airbnb rental taxable?

Taxable rental income is the gross amount of rent received less any allowable expenses. This can also be referred to as ‘net’ rental income.

Airbnb EGift Card (1002000) Thank You Reward for Our Client

Taxable rental income is the gross amount of rent received less any allowable expenses. This can also be referred to as ‘net’ rental income.

[Ask the Tax Whiz] Is Airbnb taxable in the Philippines?

This can also be referred to as ‘net’ rental income. Taxable rental income is the gross amount of rent received less any allowable expenses.

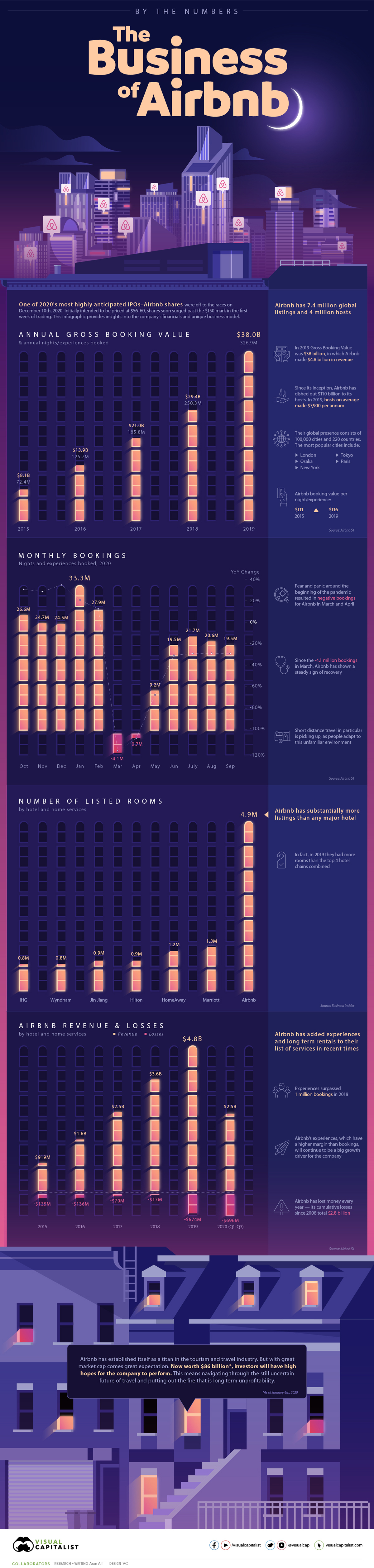

The Business of Airbnb, by the Numbers Investment Watch Blog

This can also be referred to as ‘net’ rental income. Taxable rental income is the gross amount of rent received less any allowable expenses.

App Economy Insights on Twitter "ABNB Airbnb's Statement."

Taxable rental income is the gross amount of rent received less any allowable expenses. This can also be referred to as ‘net’ rental income.

Is your Airbnb rental taxable?

Taxable rental income is the gross amount of rent received less any allowable expenses. This can also be referred to as ‘net’ rental income.

Tax on Airbnb NZ is my Airbnb taxable?

This can also be referred to as ‘net’ rental income. Taxable rental income is the gross amount of rent received less any allowable expenses.

This Can Also Be Referred To As ‘Net’ Rental Income.

Taxable rental income is the gross amount of rent received less any allowable expenses.

![[Ask the Tax Whiz] Is Airbnb taxable in the Philippines?](https://www.rappler.com/tachyon/2021/06/airbnb-shutterstock-sq.jpg)